Mangalam Cement Ltd is an Indian company that manufactures and sells cement. Mangalam Cement Share Price on NSE as of 5 September 2024 is 1,023.20 INR. On this page, you will find Mangalam Cement Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Mangalam Cement takeover News, Mangalam Cement owner, Mangalam Cement merger with UltraTech Cement, Mangalam Cement latest News, Mangalam cement share price target tomorrow, and more Information.

Mangalam Cement Ltd Company Details

Mangalam Cement Ltd is an Indian company that manufactures and sells cement. Established in 1978, it is a part of the B.K. Birla Group and produces high-quality cement under the brand names “Birla Uttam” and “Birla Uttam Cement.” Known for its reliable and durable products, Mangalam Cement plays a significant role in the construction industry, contributing to infrastructure development across the country.

| Official Website | mangalamcement.com |

| Headquarters | India |

| Number of employees | 1,031 (2024) |

| Subsidiary | Mangalam Timber Products Ltd. |

| Category | Share Price |

Current Market Overview Of Mangalam Cement Share Price

- Open Price: ₹1,039.95

- High Price: ₹1,039.95

- Low Price: ₹1,011.00

- Current Price: ₹1,023.20

- Market Capitalization: ₹2.81K Crores

- P/E Ratio: 45.25

- Dividend Yield: 0.15%

- 52-Week High: ₹1,093.70

- 52-Week Low: ₹351.45

Mangalam Cement Share Price Recent Chart

Read Also:- Gujarat Gas Share Price Target 2024, 2025 to 2030 and More Details

Mangalam Cement Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of Mangalam Cement for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Mangalam Cement Share Price Target Years | SHARE PRICE TARGET |

| 1 | Mangalam Cement Share Price Target 2024 | ₹1140 |

| 2 | Mangalam Cement Share Price Target 2025 | ₹1690 |

| 3 | Mangalam Cement Share Price Target 2026 | ₹1935 |

| 4 | Mangalam Cement Share Price Target 2027 | ₹2215 |

| 5 | Mangalam Cement Share Price Target 2028 | ₹2536 |

| 6 | Mangalam Cement Share Price Target 2029 | ₹2909 |

| 7 | Mangalam Cement Share Price Target 2030 | ₹3329 |

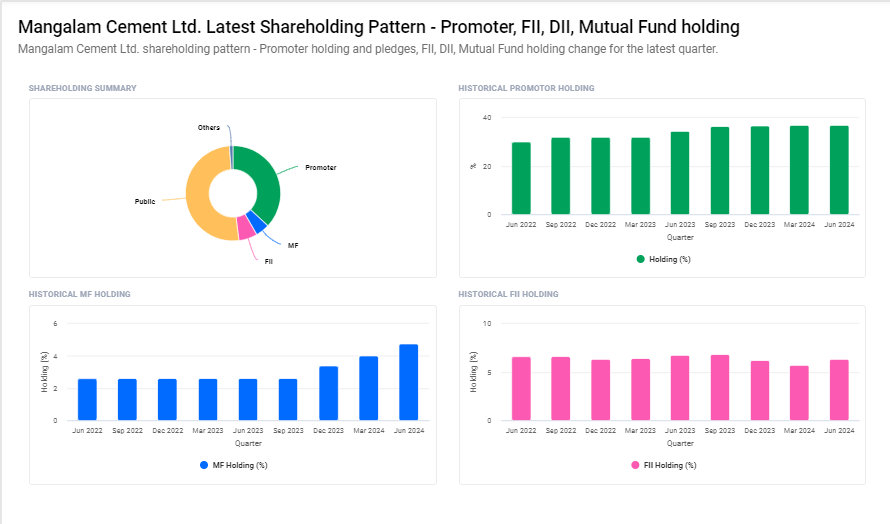

Mangalam Cement Shareholding Pattern

- Retail and Others: 50.79%

- Promoters: 36.94%

- Foreign Institutions: 6.32%

- Mutual Funds: 4.74%

- Other Domestic Institutions: 1.21%

Factors Affecting Mangalam Cement Share Price Growth

-

Demand for Construction: An increase in infrastructure projects and housing developments directly boosts the demand for cement, positively influencing Mangalam Cement’s share price.

- Raw Material Costs: The price of key raw materials like limestone, coal, and fuel can significantly affect production costs, impacting profit margins and share price growth.

- Government Policies: Supportive policies or government infrastructure initiatives can lead to higher demand for cement, thereby increasing the company’s share price.

- Economic Conditions: A strong economy generally drives construction activities, leading to higher sales for Mangalam Cement, contributing to share price growth.

-

Competition in the Industry: Competitive pricing and innovation within the cement industry play a role in determining market share and can either enhance or limit Mangalam Cement’s growth potential.

Risks and Challenges to Mangalam Cement Share Price

-

Fluctuating Raw Material Costs: Volatility in the prices of key materials like limestone, coal, and energy can increase production costs, putting pressure on profit margins and impacting the share price.

- Economic Slowdown: A decline in construction activities due to an economic downturn can reduce demand for cement, negatively affecting the company’s revenue and share performance.

- Government Regulations: Stricter environmental regulations or changes in tax policies could increase operational costs for Mangalam Cement, posing a risk to its profitability and stock value.

- Intense Competition: Growing competition from other cement manufacturers may force the company to lower prices or invest heavily in marketing, which could squeeze margins and affect the share price.

-

Supply Chain Disruptions: Delays in procuring raw materials or transportation issues can lead to production halts, affecting revenue and investor confidence in the stock.

Read Also:-

- Bajaj Hindusthan Sugar Share Price Target

- TCS Share Price Target

- Kalyan Jewellers Share Price Target

- Waaree Renewables Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.