Trent Limited, a Mumbai-based company under the Tata Group, is a key player in the Indian retail market. Established in 1998, Trent manages popular fashion and lifestyle brands like Westside, Zudio, and Utsa. In addition to these brands, Trent also operates well-known retail chains such as Star Bazaar and partners with Zara through joint ventures, offering a variety of shopping experiences across the country. Zudio Share Price on NSE as of 3 September 2024 is 7,040.15 INR. This article will provide more details on Zudio Share Price Target 2024, 2025, 2026 to 2030.

ZUDIO Information

Zudio is a popular fashion retail brand in India known for offering trendy and affordable clothing. It caters to men, women, and children, providing a wide range of stylish options, from casual wear to ethnic outfits. With its focus on quality and affordability, Zudio has quickly become a favorite destination for shoppers looking for the latest fashion without breaking the bank. The brand is part of Trent Limited, a subsidiary of the Tata Group, and continues to expand its presence across various cities in India.

| Official Website | trentlimited.com |

| CEO | P. Venkatesalu (6 Oct 2021–) |

| Chairman | Noel Tata |

| Founded | 1952 |

| Headquarters |

Mumbai, Maharashtra, India

|

| Parent organization | Tata Group |

| Number of employees | 25,277 (2024) |

| Category | Share Price |

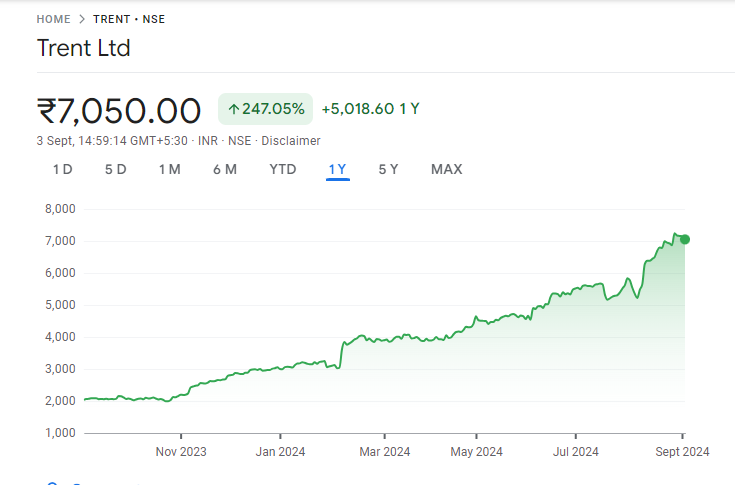

Current Market Overview Of ZUDIO Share Price

- Open – INR 7,179.00

- High – INR 7,180.00

- Low – INR 6,995.00

- Current Price – INR 7,040.15

- Mkt cap – INR 2.51LCr

- P/E ratio – 147.02

- Div yield – 0.045%

- 52-wk high – INR 7,325.00

- 52-wk low – INR 1,945.00

ZUDIO Share Price Recent Graph

Read Also:- Rattan Power Share Price Target 2024, 2025, 2026 To 2030 Prediction

ZUDIO Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Zudio for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Zudio Share Price Target Years | SHARE PRICE TARGET |

| 1 | Zudio Share Price Target 2024 | ₹9130 |

| 2 | Zudio Share Price Target 2025 | ₹9960 |

| 3 | Zudio Share Price Target 2026 | ₹11325 |

| 4 | Zudio Share Price Target 2027 | ₹12020 |

| 5 | Zudio Share Price Target 2028 | ₹13880 |

| 6 | Zudio Share Price Target 2029 | ₹14035 |

| 7 | Zudio Share Price Target 2030 | ₹15495 |

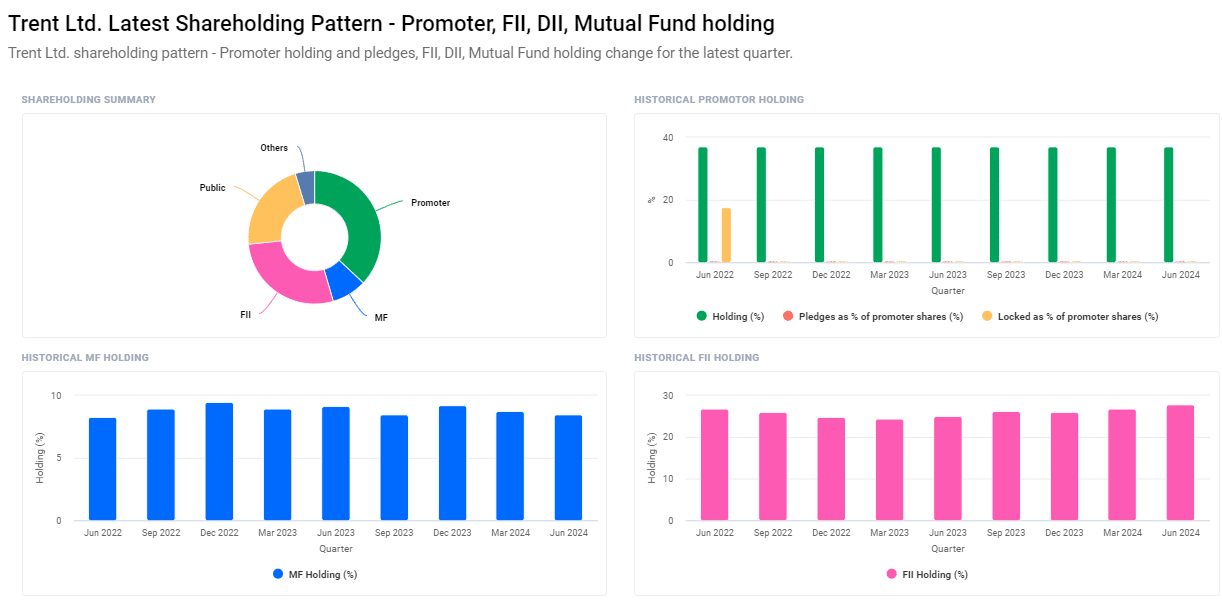

Shareholding Pattern For ZUDIO

- Promoters: 37.01%

- Foreign Institutions (FII/FPI): 27.87%

- Retail and Others: 21.94%

- Mutual Funds: 8.50%

- Other Domestic Institutions: 4.69%

Risks and Challenges to Zudio Share Price

-

Market Competition: Zudio faces stiff competition from other established fashion retail brands, both domestic and international. This intense competition can impact market share and profitability, putting pressure on Zudio’s share price.

- Changing Consumer Preferences: The fashion industry is known for rapidly changing trends. If Zudio fails to adapt to new styles and consumer demands, it may lose its appeal, which could negatively affect its sales and share price.

- Economic Slowdown: An economic downturn can lead to reduced consumer spending on non-essential items like fashion. This decrease in spending can impact Zudio’s revenue, thereby affecting its share price.

- Supply Chain Disruptions: Any issues in the supply chain, such as delays or increased costs of materials, can disrupt Zudio’s operations. This can lead to stock shortages or higher prices, impacting sales and profitability.

- Regulatory Changes: Changes in government regulations related to retail operations, import duties, or taxation can increase operational costs for Zudio. These regulatory challenges can affect profitability and, consequently, the share price.

-

Brand Reputation: Any negative publicity or issues related to product quality, labor practices, or customer service can harm Zudio’s brand reputation. A damaged reputation can lead to a loss of customer trust and loyalty, impacting sales and the company’s share price.

Read Also:-

- DMart Share Price Target

- Lotus Chocolate Share Price Target

- RBL Share Price Target

- REC Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.