Franklin Industries Ltd is a company that manufactures and supplies industrial products and solutions. Franklin Industries Share Price on NSE as of 21 September 2024 is 1.96 INR. On this page, you will find Franklin Industries Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Franklin Industries share price target tomorrow, Franklin Industries Share Price Target 2025 moneycontrol, Franklin Industries share price target 2030, and more Information.

Franklin Industries Ltd Company Details

Franklin Industries Ltd is a company that manufactures and supplies industrial products and solutions. Known for its commitment to quality and innovation, Franklin Industries provides a wide range of products that cater to different sectors, including construction, engineering, and manufacturing. With a focus on sustainability and customer satisfaction, the company aims to deliver reliable and efficient products that meet the diverse needs of its clients.

| Official Website | franklinindustries.in |

| Founded | 1983 |

| Headquarters | India |

| Subsidiary | Aphrodite Industries Limited |

| Category | Share Price |

Current Market Overview Of Franklin Industries Share Price

- Open: INR 1.97

- High: INR 1.97

- Low: INR 1.96

- Current Price: 1.96

- Market Cap: INR 56.68 Crore

- P/E Ratio: 1.06

- Dividend Yield: N/A

- 52-Week High: INR 4.13

- 52-Week Low: INR 1.01

Franklin Industries Share Price Today Chart

Read Also:- Syncom Formulations Share Price Target 2024, 2025 to 2030

Franklin Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Franklin Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Franklin Industries Share Price TargetYears | SHARE PRICE TARGET |

| 1 | Franklin Industries Share Price Target 2024 | ₹9.80 |

| 2 | Franklin Industries Share Price Target 2025 | ₹12.45 |

| 3 | Franklin Industries Share Price Target 2026 | ₹14.85 |

| 4 | Franklin Industries Share Price Target 2027 | ₹16.98 |

| 5 | Franklin Industries Share Price Target 2028 | ₹18.87 |

| 6 | Franklin Industries Share Price Target 2029 | ₹20.56 |

| 7 | Franklin Industries Share Price Target 2030 | ₹22.87 |

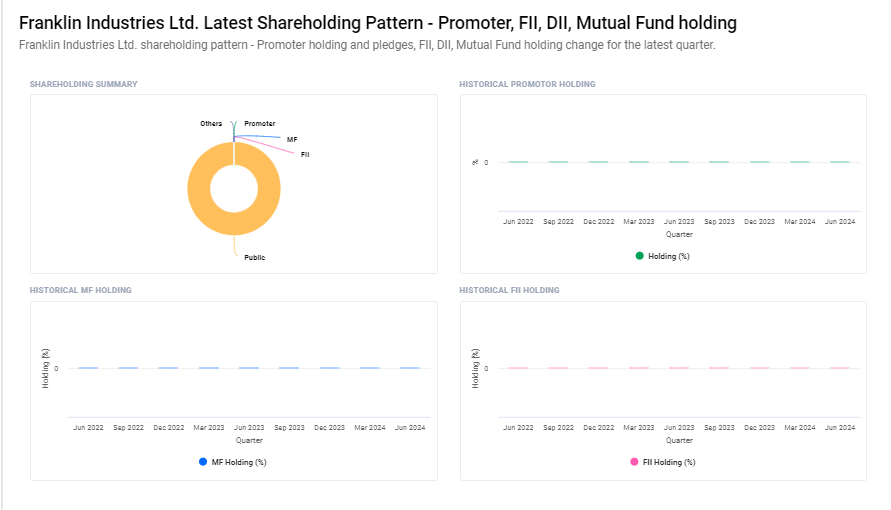

Shareholding Pattern For Franklin Industries

- Retail and Others: 99.92%

- Other Domestic Institutions: 0.08%

Factors Affecting Franklin Industries Share Price Growth

Here are seven key factors that can influence the share price growth of Franklin Industries Ltd:

- Market Demand: The demand for Franklin Industries’ products and services plays a crucial role in its share price growth. Higher demand can lead to increased sales and revenue, which positively affects the share price.

- Product Innovation: Introducing new and innovative products can set Franklin Industries apart from competitors. Successful innovation can attract more customers and boost the company’s reputation, leading to potential share price growth.

- Economic Conditions: The overall economic environment, including factors like inflation, interest rates, and economic growth, can impact consumer spending and business investment, which in turn affects Franklin Industries’ financial performance and share price.

- Cost Management: Efficient management of production costs and operational expenses can improve profitability. When Franklin Industries manages costs effectively, it can enhance its profit margins, which may lead to a positive impact on the share price.

- Competitive Positioning: Franklin Industries’ ability to maintain a competitive edge in the market can influence its share price. A strong market position helps in retaining customers and gaining market share, which can drive share price growth.

- Regulatory Environment: Changes in regulations and compliance requirements can affect Franklin Industries’ operations. Adapting to new regulations without significant costs can help maintain stability and growth in the share price.

-

Investor Sentiment: Positive investor sentiment, influenced by news, earnings reports, and industry trends, can lead to increased demand for Franklin Industries’ shares. When investors are optimistic about the company’s future, it often results in share price growth.

Read Also:-

- Zen Technologies Share Price Target

- PCBL Share Price Target

- Genus Power Share Price Target

- CDSL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.