GRSE Company Details

Garden Reach Shipbuilders & Engineers Ltd, often known as GRSE, is a prominent shipbuilding company based in India. Located in Kolkata, GRSE is known for building and repairing a wide range of naval and commercial ships. With a strong legacy in maritime engineering, the company plays a crucial role in supporting the Indian Navy and Coast Guard, providing high-quality vessels and innovative engineering solutions. GRSE is renowned for its commitment to quality, reliability, and technological advancement in shipbuilding.

| GRSE Full Form | Garden Reach Shipbuilders & Enginers |

| Official Website | grse.in |

| Founded | 1884 |

| Headquarters |

Kolkata, West Bengal, India

|

| Chairman & MD | Cmde PR Hari,IN (Retd.) |

| Number of employees | 1,649 (2024) |

| Category | Share Price |

Current Market Overview Of GRSE Share Price

- Open – ₹ 1,879.20

- High – ₹ 1,974.80

- Low – ₹ 1,857.05

- Current Price – ₹ 1,919.00

- Mkt cap – ₹ 21.94KCr

- P/E ratio – 59.66

- Div yield – 0.45%

- 52-wk high – ₹ 2,833.80

- 52-wk low – ₹ 648.30

GRSE Share Price Recent Graph

Read Also:- Mtnl Share Price Target 2024, 2025, 2026, 2027 To 2030 Prediction

GRSE Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of GRSE for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | GRSE Share Price Target Years | Share Price Target |

| 1 | GRSE Share Price Target 2024 | ₹2510 |

| 2 | GRSE Share Price Target 2025 | ₹3490 |

| 3 | GRSE Share Price Target 2026 | ₹4160 |

| 4 | GRSE Share Price Target 2027 | ₹5880 |

| 5 | GRSE Share Price Target 2028 | ₹6750 |

| 6 | GRSE Share Price Target 2029 | ₹7701 |

| 7 | GRSE Share Price Target 2030 | ₹8825 |

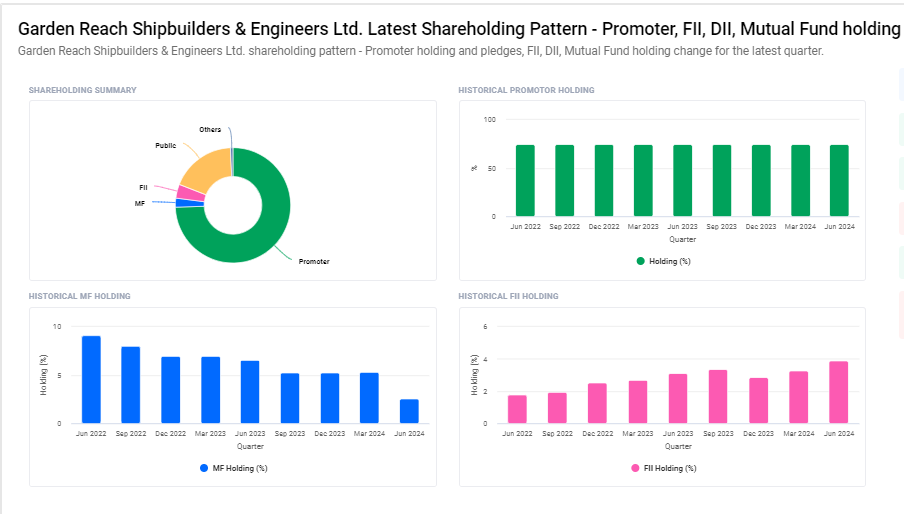

Shareholding Pattern for GRSE

| Promoters | 74.5% |

| FIIs | 3.91% |

| DIIs | 3.2% |

| Public | 18.38% |

| Other | 0% |

Factors Affecting GRSE Share Price Growth

-

Government Contracts: GRSE’s performance heavily relies on securing contracts from the Indian government, especially for defense projects. Winning more contracts can boost its revenue and, in turn, positively impact its share price.

- Export Opportunities: Expanding its market through international ship exports can enhance GRSE’s growth prospects. Increased export orders can lead to higher earnings and drive up the share price.

- Technological Advancements: Investment in modern technology and innovation can help GRSE improve efficiency and reduce costs. Such advancements can make the company more competitive and attractive to investors, supporting share price growth.

- Economic Conditions: The overall economic environment plays a significant role. A strong economy usually means higher defense spending, which can lead to more contracts for GRSE. Conversely, economic downturns might lead to budget cuts and affect the company’s growth.

-

Regulatory Policies: Changes in government policies, especially those related to defense and manufacturing, can impact GRSE’s operations. Favorable regulations can provide a growth boost, while restrictive policies may pose challenges to the company.

Risks and Challenges to GRSE Share Price

-

Dependence on Government Contracts: GRSE relies heavily on contracts from the Indian government, particularly for defense projects. Any reduction in government spending or delays in contract awards can directly impact its revenue and share price.

- Competition: The shipbuilding industry is competitive, with both domestic and international players vying for the same contracts. Increased competition can lead to price wars and reduced profit margins, posing a challenge to GRSE’s profitability and stock value.

- Economic Fluctuations: Economic downturns or instability can lead to reduced defense budgets, affecting the number of contracts available for GRSE. Economic factors like inflation and currency fluctuations can also increase costs and affect profitability.

- Regulatory Changes: Changes in government policies or regulations related to defense procurement, environmental standards, or labor laws can impact GRSE’s operations. Compliance with new regulations may increase costs or limit business opportunities.

-

Project Delays and Cost Overruns: Large shipbuilding projects are complex and can face delays due to technical challenges, supply chain issues, or labor disputes. Delays and cost overruns can strain GRSE’s resources, leading to financial losses and negatively affecting the share price.

Read Also:-

- Federal Bank Share Price Target

- HDFC AMC Share Price Target

- KEC International Share Price Target

- IOB Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.