KEC International Ltd Company Details

KEC International Ltd is a leading Indian company specializing in engineering, procurement, and construction (EPC) services. It operates in multiple sectors, including power transmission and distribution, railways, civil construction, and renewable energy. With a strong presence both in India and internationally, KEC International has built a reputation for delivering complex projects on time and with high quality. The company’s innovative approach and commitment to excellence make it a trusted partner in infrastructure development around the world.

| Official Website | kecrpg.com |

| CEO | Vimal Kejriwal (Apr 2015–) |

| Founded | 7 May 1945 |

| Founder | Ramji H. Kamani |

| Headquarters |

Worli, Mumbai, Maharashtra, India

|

| Number of employees | 6,450 (2024) |

| Category | Share Price |

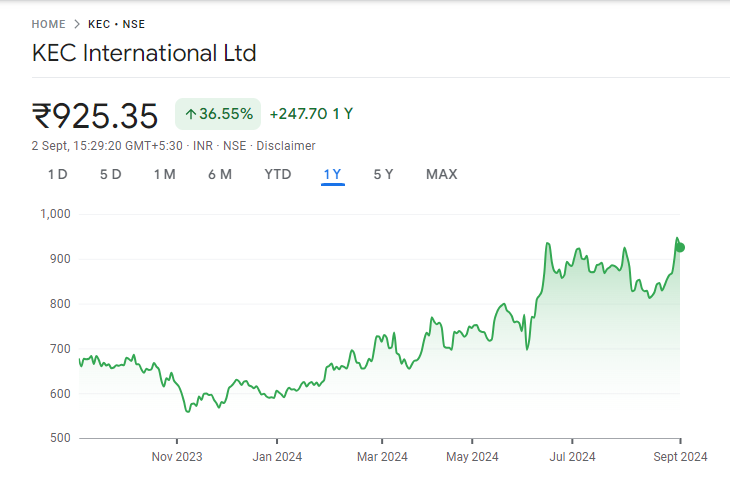

Current Market Overview Of KEC International Share Price

- Open – ₹ 956.00

- High – ₹ 959.90

- Low – ₹ 920.80

- Current Price – ₹ 923.20

- Mkt cap – ₹ 23.73KCr

- P/E ratio – 60.56

- Div yield – 0.43%

- 52-wk high – ₹ 969.00

- 52-wk low – ₹ 550.05

KEC International Share Price Recent Graph

Read Also:- NIIT Ltd Share Price Target 2024, 2025, 2026, 2027 To 2030

KEC International Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of KEC International for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | KEC International Share Price Target Years | KEC International Share Price |

| 1 | KEC International Share Price Target 2024 | ₹955 |

| 2 | KEC International Share Price Target 2025 | ₹ 1420 |

| 3 | KEC International Share Price Target 2026 | ₹ 1755 |

| 4 | KEC International Share Price Target 2027 | ₹2125 |

| 5 | KEC International Share Price Target 2028 | ₹2450 |

| 6 | KEC International Share Price Target 2029 | ₹2779 |

| 7 | KEC International Share Price Target 2030 | ₹3000 |

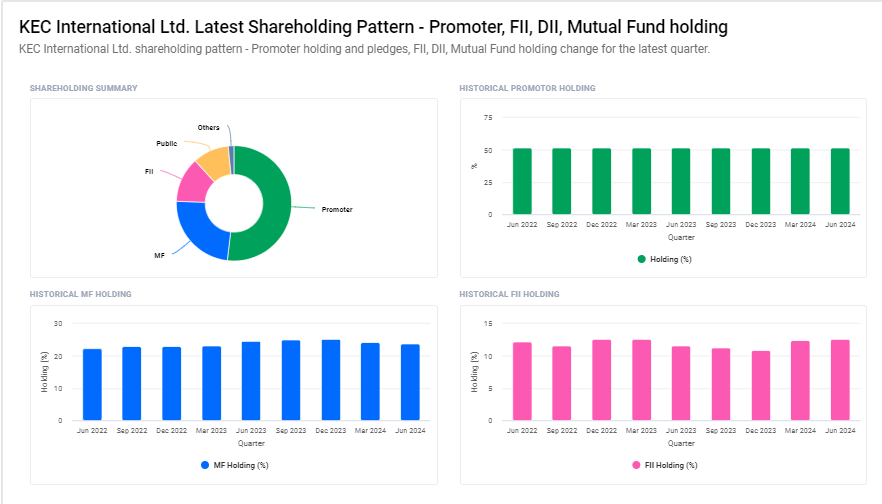

Shareholding Pattern For KEC International

- Promoters: 51.9%

- Foreign Institutions: 12.7%

- Public: 10.2%

- Domestic Institutions: 25.3%

Risks and Challenges to KEC International Share Price

Here are six points outlining the risks and challenges that could affect KEC International’s share price:

- Fluctuating Raw Material Costs: Changes in the prices of key raw materials, such as steel and other metals, can impact the company’s profitability. Higher costs can reduce profit margins, which may negatively affect the share price.

- Exchange Rate Volatility: As a multinational company, KEC International deals with various currencies. Fluctuations in exchange rates can lead to financial losses, especially if the company’s revenues are in different currencies compared to its costs.

- Project Delays: Delays in the execution of large-scale projects, whether due to regulatory approvals, environmental concerns, or logistical issues, can lead to increased costs and reduced revenues, impacting the company’s financial performance and share price.

- Competitive Pressure: The power transmission and EPC sectors are highly competitive. Aggressive pricing by competitors or the entry of new players can erode KEC International’s market share, affecting its profitability and stock valuation.

- Regulatory and Political Risks: Changes in government policies, regulations, or political instability in countries where KEC International operates can create uncertainties. These factors might lead to increased compliance costs or impact the ability to secure new contracts.

-

Interest Rate Fluctuations: As a company involved in large infrastructure projects, KEC International often relies on debt financing. Changes in interest rates can increase borrowing costs, impacting net profits and potentially leading to a decrease in the share price.

Read Also:-

- Mtnl Share Price Target

- Genus Power Share Price Target

- PCBL Share Price Target

- Zen Technologies Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.