Hello friends, Do you want to know about the future value of Mtnl share price target? So you have come to the right page. Mtnl Share Price on NSE as of 2 September 2024 is 59.61 INR. On this page, you will find Mtnl Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as MTNL share price target by experts tomorrow, MTNL share price target by expertsMTNL Share Price target 2025 in Hindi, Mtnl share price target tomorrow, and more Information.

Mahanagar Telephone Nigam Ltd Company Details

Mahanagar Telephone Nigam Ltd (MTNL) is a state-owned telecommunications company in India. Established in 1986, MTNL provides telecom services like landline, mobile, and broadband internet primarily in the cities of Mumbai and New Delhi.

As a public sector undertaking, MTNL plays a vital role in connecting people and businesses, offering reliable communication solutions. Despite facing tough competition from private telecom players, MTNL continues to serve millions of customers, focusing on improving its services and expanding its reach to stay relevant in the fast-evolving telecom industry.

| Official Website | mtnl.net.in |

| CEO | Sunil Kumar (24 Jul 2019–) |

| Founded | 1 April 1986 |

| Founder | Government of India |

| Chairman & MD BSNL | ROBERT J RAVI, ITS |

| Headquarters | Mahanagar Doorsanchar Sadan, 9, CGO Complex, Lodhi Road, New Delhi, India |

| Number of employees | 3,567 (2023) |

| Category | Share Price |

Current Market Overview Of Mtnl Share Price

- Open Price: ₹60.60

- High Price: ₹60.80

- Low Price: ₹59.30

- Market Capitalization: ₹3.75K Crores

- Price-to-Earnings (P/E) Ratio: N/A

- Dividend Yield: N/A

- 52-Week High: ₹101.93

- 52-Week Low: ₹22.40

- Current Price: ₹59.61

Mtnl Share Price Recent Graph

Mtnl Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of MTNL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | MTNL Share Price Target Years | SHARE PRICE TARGET |

| 1 | MTNL Share Price Target 2024 | ₹85 |

| 2 | MTNL Share Price Target 2025 | ₹98 |

| 3 | MTNL Share Price Target 2026 | ₹112 |

| 4 | MTNL Share Price Target 2027 | ₹124 |

| 5 | MTNL Share Price Target 2028 | ₹138 |

| 6 | MTNL Share Price Target 2029 | ₹157 |

| 7 | MTNL Share Price Target 2030 | ₹177 |

Read Also:- CG Power Share Price Target 2024, 2025, 2026 to 2030 Prediction

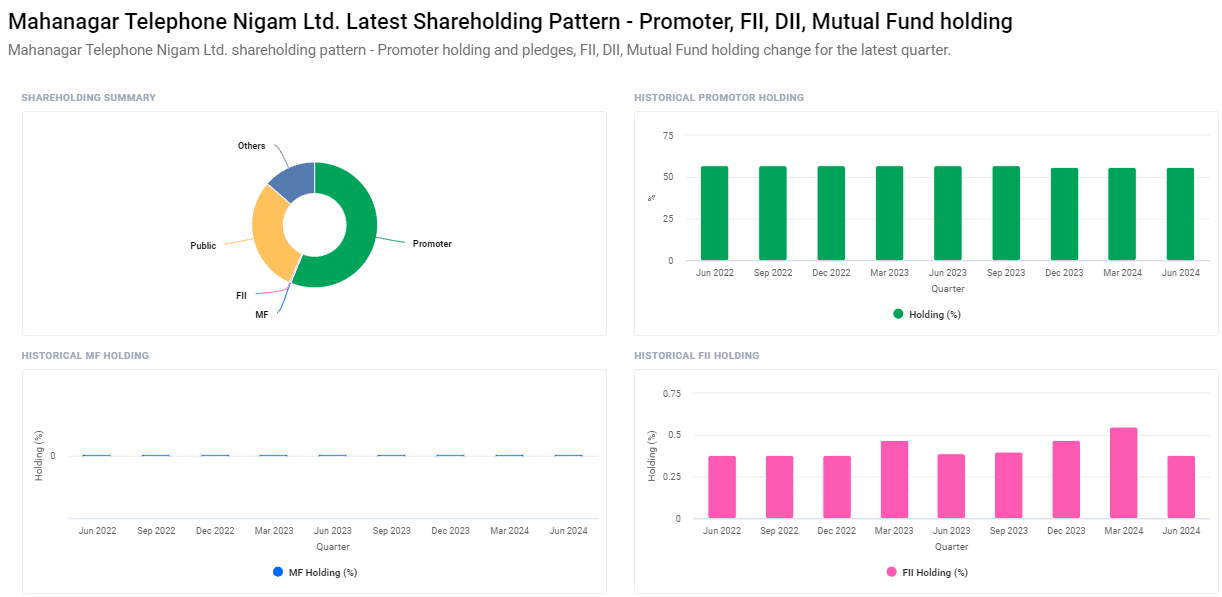

Shareholding Pattern For Mtnl Share Price

- Promoters: 56.25% (unchanged)

- Retail and Others: 29.73%

- Other Domestic Institutions: 13.63%

- Foreign Institutions (FII/FPI): 0.38% (reduced from 0.55%)

Risks and Challenges For MTNL Share Price

-

Intense Competition: MTNL faces stiff competition from private telecom companies that offer more competitive pricing and advanced services. This makes it challenging for MTNL to attract and retain customers, affecting its market share and, consequently, its share price.

- Financial Struggles: The company has been dealing with financial difficulties for several years, including high levels of debt and operational losses. These financial constraints limit MTNL’s ability to invest in upgrading its infrastructure and expanding its services, which can impact investor confidence and share prices.

- Technological Obsolescence: As technology rapidly evolves, MTNL struggles to keep up with the latest advancements, such as 5G. Lagging in technology adoption can lead to a decline in customer satisfaction and competitiveness, which may negatively influence its share price.

- Regulatory Challenges: Changes in government regulations and policies in the telecom sector can pose risks to MTNL. Compliance with new regulations might require additional investments, and any unfavorable policy changes could impact MTNL’s operations and profitability.

- Limited Market Presence: Unlike its competitors, MTNL’s operations are primarily limited to Mumbai and New Delhi. This restricted geographical presence limits its revenue potential and exposes the company to higher market risks, which can impact its share price.

-

Aging Infrastructure: MTNL’s infrastructure is aging and requires significant upgrades to meet modern standards. Delays or failures in infrastructure improvements could lead to service disruptions, customer dissatisfaction, and ultimately, a decline in the share price.

Factors Affecting MTNL Share Price Growth

-

Government Support: As MTNL is a government-owned company, any support or initiatives from the government, such as financial bailouts, subsidies, or favorable policies, can positively impact its share price by boosting investor confidence.

- Expansion of Services: Efforts to expand and modernize MTNL’s telecom infrastructure, such as rolling out 4G and 5G services, can attract more customers, increase revenue, and increase share price growth.

- Strategic Partnerships: Forming alliances or partnerships with other telecom companies or technology providers can help MTNL improve its service offerings, reduce costs, and enhance its market position, which can positively influence its share price.

- Debt Reduction: Efforts to reduce debt through restructuring, asset sales, or government assistance can improve MTNL’s financial health. Lower debt levels can lead to better profitability and investor confidence, increasing the share price.

-

Customer Base Growth: Increasing the number of subscribers through competitive pricing, improved service quality, or marketing efforts can boost revenue. A growing customer base can indicate business growth potential, which may increase share price.

Read Also:-

- Campus Share Price Target

- Motisons Jewellers Share Price Target

- HUDCO Share Price Target

- Orient Green Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.