HPCL is a public sector company in India, specializing in the petroleum and natural gas industry. HPCL Share Price on NSE as of 30 August 2024 is 419.70 INR. On this page, you will find HPCL Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as HPCL share News today, HPCL share price target tomorrow, HPCL share price target 2024 Moneycontrol, and more Information.

Hindustan Petroleum Corp Ltd Details

Hindustan Petroleum Corporation Ltd (HPCL) is a major oil and gas company in India. It is known for refining and marketing petroleum products like petrol, diesel, and lubricants. With a vast network of fuel stations across the country, HPCL plays a crucial role in meeting India’s energy needs. The company is also involved in exploring new energy sources, including renewable energy, to support sustainable growth. HPCL is well-regarded for its focus on innovation and customer service, making it a key player in India’s energy sector.

| Official Website | hindustanpetroleum.com |

| Founded | 1974 |

| Headquarters | Mumbai, Maharashtra, India |

| CMD | Pushp Kumar Joshi |

| Number of employees | 8,154 (2024) |

| Category | Share Price |

Current Market Overview Of HPCL Share Price

- Open Price: ₹421.40

- High Price: ₹425.25

- Low Price: ₹415.75

- Current Price: ₹410.80

- Market Capitalization: ₹89.17K Crore

- P/E Ratio: 9.04

- Dividend Yield: 5.00%

- 52-Week High: ₹425.25

- 52-Week Low: ₹159.47

HPCL Share Price Recent Graph

Read Also:- OM Infra Share Price Target 2024, 2025 To 2030 and More Details

HPCL Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of HPCL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | HPCL Share Price Target Years | Share Price Target |

| 1 | HPCL Share Price Target 2024 | ₹590 |

| 2 | HPCL Share Price Target 2025 | ₹680 |

| 3 | HPCL Share Price Target 2026 | ₹760 |

| 4 | HPCL Share Price Target 2027 | ₹855 |

| 5 | HPCL Share Price Target 2028 | ₹950 |

| 6 | HPCL Share Price Target 2029 | ₹1,035 |

| 7 | HPCL Share Price Target 2030 | ₹1,125 |

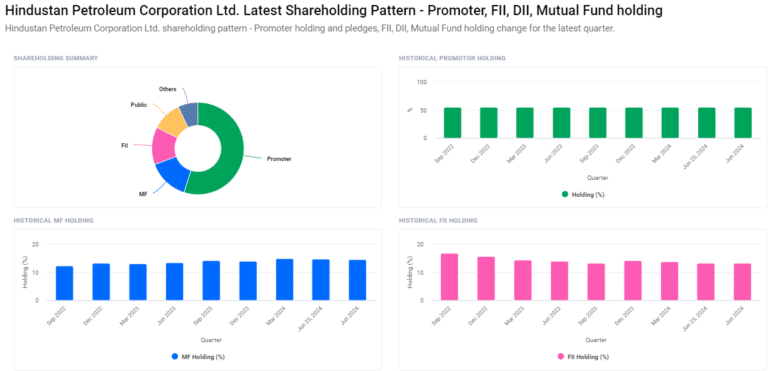

Shareholding Pattern For HPCL Share Price

- Promoters: 54.90%

- Mutual Funds: 14.50%

- Foreign Institutional Investors (FII): 13.22%

- Retail and Others: 10.40%

- Other Domestic Institutions: 6.97%

Factors Affecting HPCL Share Price Growth

Here are five key factors that can impact the share price growth of HPCL:

- Crude Oil Prices: HPCL’s performance is closely tied to global crude oil prices. Fluctuations in oil prices can directly affect its profit margins and overall financial health.

- Government Policies: As a public sector enterprise, HPCL is influenced by government regulations and policies related to fuel pricing, subsidies, and taxation. Changes in these policies can significantly impact its operations and share price.

- Economic Conditions: The broader economic environment, including inflation rates, economic growth, and currency fluctuations, can influence HPCL’s financial performance and investor sentiment.

- Demand and Supply Dynamics: Variations in the demand for petroleum products and the supply chain efficiency can affect HPCL’s revenue and operational costs, impacting its share price.

-

Market Competition: The competitive landscape in the energy sector, including the performance of rival companies and new market entrants, can influence HPCL’s market share and profitability, thereby affecting its share price.

Read Also:-

- Sun TV Share Price Target

- HCC Share Price Target

- Kotak Mahindra Bank Share Price Target

- Balrampur Chini Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.