CDSL, a central securities depository in India, holds the distinction of being the largest in the country by the number of demat accounts. CDSL Share Price on NSE as of 30 August 2024 is 1,435.00 INR. On this page, you will find CDSL Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as CDSL share price target tomorrow, CDSL share price target 2040, CDSL share Price target 2025 moneycontrol, and more Information.

Central Depository Services (India) Ltd Company Details

Central Depository Services (India) Ltd (CDSL) is a leading securities depository in India, established in 1999. It offers services that enable investors to hold and trade securities like stocks and bonds in electronic form, making transactions safer and more efficient.

CDSL plays a crucial role in the Indian financial market by providing services to various participants, including investors, stock exchanges, and clearing corporations. With its focus on innovation and customer satisfaction, CDSL continues to enhance the ease of investing and trading in the Indian stock market.

| Official Website | cdslindia.com |

| Founded | February 1999 |

| Headquarters | Mumbai, India |

| Managing Director & Chief Executive Officer | Nehal Vora |

| Number of employees | 335 (2024) |

| Category | Share Price |

Current Market Overview Of CDSL Share Price

- Open Price: ₹1,431.15

- High Price: ₹1,470.00

- Low Price: ₹1,405.00

- Current Price: ₹1,435.00

- Market Capitalization: ₹29.99K Crore

- P/E Ratio: 62.51

- Dividend Yield: 0.66%

- 52-Week High: ₹1,664.40

- 52-Week Low: ₹553.68

CDSL Share Price Recent Graph

CDSL Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of CDSL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | CDSL Share Price Target Years | SHARE PRICE TARGET |

| 1 | CDSL Share Price Target 2024 | ₹1830 |

| 2 | CDSL Share Price Target 2025 | ₹2203 |

| 3 | CDSL Share Price Target 2026 | ₹2452 |

| 4 | CDSL Share Price Target 2027 | ₹2665 |

| 5 | CDSL Share Price Target 2028 | ₹3651 |

| 6 | CDSL Share Price Target 2029 | ₹4321 |

| 7 | CDSL Share Price Target 2030 | ₹5090 |

Read Also:- Filatex Share Price Target 2024, 2025 to 2030 and More Details

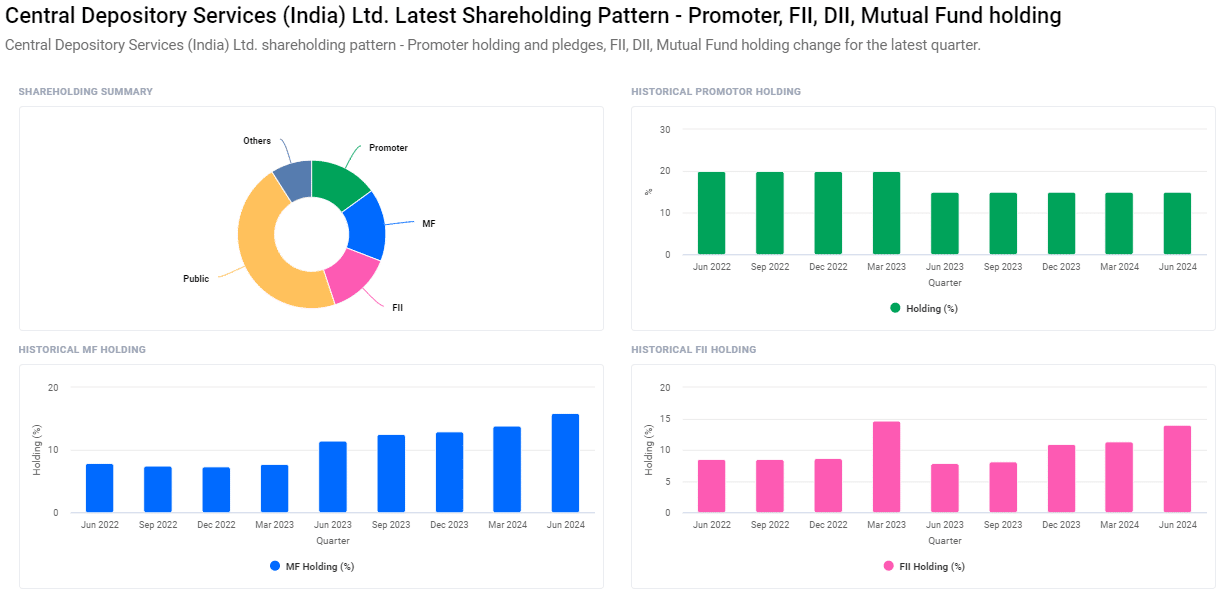

Shareholding Pattern For CDSL Share Price

- Retail and Others: 46.50%

- Mutual Funds: 15.88%

- Promoters: 15.00%

- Foreign Institutional Investors (FII)/Foreign Portfolio Investors (FPI): 14.00%

- Other Domestic Institutions: 8.63%

Factors Affecting CDSL Share Price Growth

Here are five key factors that can affect CDSL’s share price growth:

- Market Activity: CDSL’s share price can be influenced by the level of trading and investment activity in the stock market. A higher number of transactions and new demat account openings typically boost their revenues.

- Regulatory Changes: Any changes in government policies or regulations related to the financial markets can impact CDSL. Positive changes can attract more investors, while stricter regulations might slow down growth.

- Technological Advancements: CDSL’s ability to integrate and offer new technological solutions for secure and efficient trading can enhance investor confidence and drive share price growth.

- Competition: The presence of other depositories and financial service providers can affect CDSL’s market share. Maintaining a competitive edge is crucial for its share price to grow.

-

Economic Conditions: The overall health of the economy, including factors like GDP growth, inflation, and employment rates, can directly impact investor sentiment and the demand for demat accounts, thereby influencing CDSL’s share price.

Risks and challenges to CDSL Share Price

Here are five key risks and challenges that could impact CDSL’s share price:

- Regulatory Risks: Changes in financial regulations or compliance requirements can create uncertainties for CDSL. Stricter regulations could increase operational costs and affect profitability, impacting share prices negatively.

- Market Volatility: Fluctuations in the stock market can directly impact CDSL’s business. A downturn or a bear market might lead to reduced trading volumes and fewer new demat accounts, which could hurt revenues.

- Technological Risks: CDSL relies heavily on technology for its operations. Cybersecurity threats, technical glitches, or failures in upgrading systems could disrupt services, leading to loss of trust among investors and negatively affecting the share price.

- Competition: Increasing competition from other depository institutions or new entrants in the market can challenge CDSL’s market share. If competitors offer better services or lower costs, CDSL might struggle to retain clients, which could affect its growth prospects.

-

Economic Slowdown: A slowdown in the overall economy can reduce investor participation in the stock markets. Economic downturns may lead to lower disposable incomes, less investment, and thus fewer new accounts and transactions, which could impact CDSL’s earnings and share price.

Read Also:-

- Genus Power Share Price Target

- Axis Bank Share Price Target

- Sun TV Share Price Target

- Rattan Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.