Genus Power Infrastructures Ltd is an Indian company specializing in power solutions. Genus Power Share Price on NSE as of 30 August 2024 is 454.95 INR. On this page, you will find Genus Power Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Genus Power news today, Genus Power share price target tomorrow, Genus Power share price target 2025 pdf, and more Information.

Genus Power Infrastructures Ltd Company Details

Genus Power Infrastructures Ltd is an Indian company specializing in power solutions. They are known for manufacturing and supplying various products, including electricity meters, power distribution equipment, and smart grid solutions. Genus Power aims to contribute to the energy sector by offering innovative and reliable products that help improve energy efficiency and management. With a strong presence in the industry, the company focuses on sustainability and technology to meet the growing demand for energy solutions in India and beyond.

| Official Website | genuspower.com |

| Headquarters | India |

| Number of employees | 1,267 (2023) |

| Subsidiaries | Genus Power Solutions Private Limited, Virtuous Urja Limited, Genus Paper Products |

| Category | Share Price |

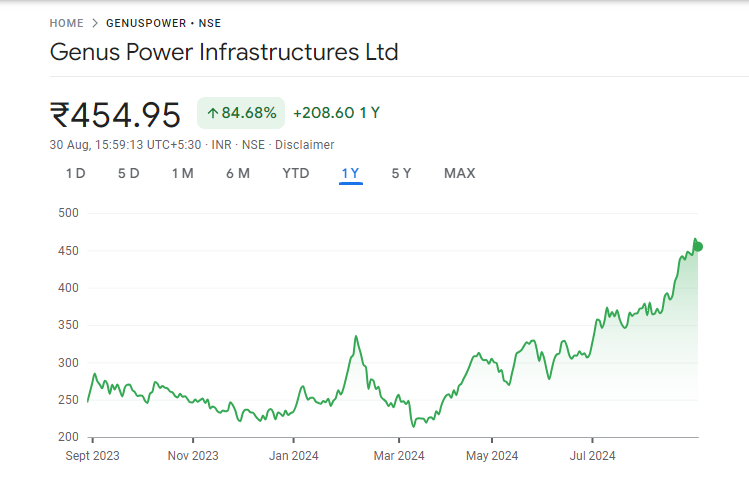

Current Market Overview Of Genus Power Share Price

- Open: ₹471.00

- High: ₹476.55

- Low: ₹452.25

- Market Cap: ₹13.84K crore

- P/E Ratio: 105.29

- Dividend Yield: N/A

- 52-Week High: ₹476.55

- 52-Week Low: ₹204.50

- Current Price: ₹454.95

Genus Power Share Price Recent Graph

Genus Power Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Genus Power for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Genus Power Share Price Target Years | SHARE PRICE TARGET |

| 1 | Genus Power Share Price Target 2024 | ₹490 |

| 2 | Genus Power Share Price Target 2025 | ₹664 |

| 3 | Genus Power Share Price Target 2026 | ₹802 |

| 4 | Genus Power Share Price Target 2027 | ₹950 |

| 5 | Genus Power Share Price Target 2028 | ₹1251 |

| 6 | Genus Power Share Price Target 2029 | ₹1480 |

| 7 | Genus Power Share Price Target 2030 | ₹1676 |

Read Also:- IRCTC Share Price Target 2024, 2025 To 2030 and More Details

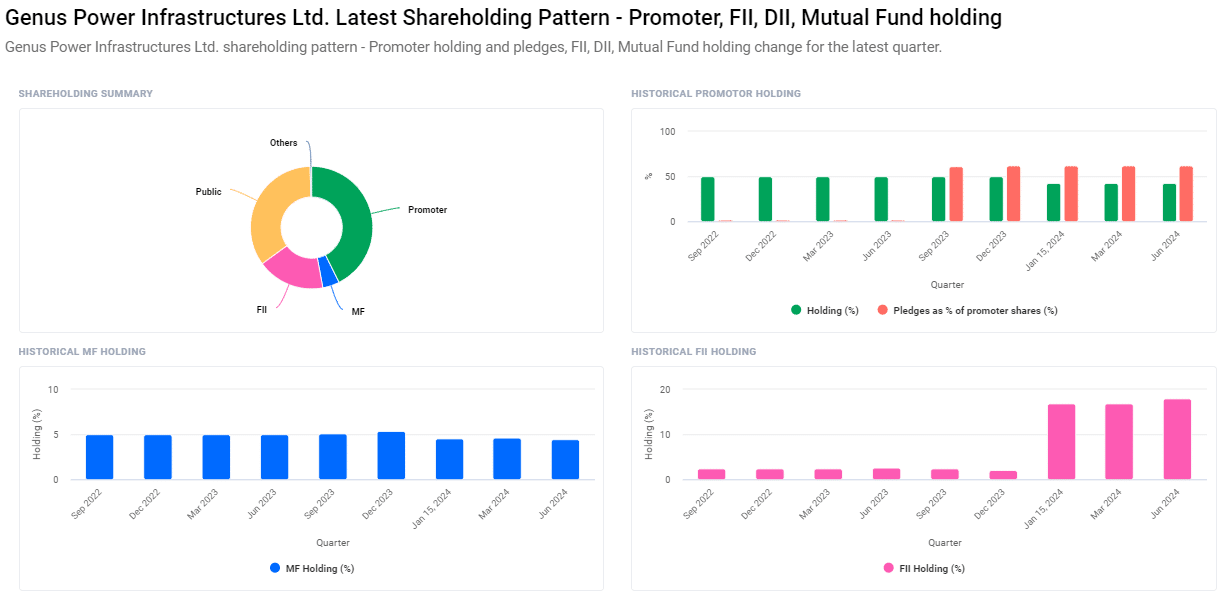

Shareholding Pattern For Genus Power Share Price

- Promoters: 40.66%

- Retail and Others: 34.63%

- Foreign Institutions: 17.91%

- Mutual Funds: 4.43%

- Other Domestic Institutions: 0.37%

Genus Power Ltd Financials 2023

| Revenue | 8.08B INR | ⬆ 18.00% YOY |

| Operating expense | 2.19B INR | ⬆ 7.60% YOY |

| Net Income | 289.74M INR | ⬇-49.57% YOY |

| Net Profit Margin | 3.58 | ⬇-57.33% YOY |

| Earnings Per Share | 1.35 | ⬆ 36.36% YOY |

| EBITDA | 788.53M | ⬆ 37.30% YOY |

| Effective Tax Rate | 34.36% |

|

| Total Assets | 16.62B INR | ⬆ 9.92% YOY |

| Total Liabilities | 6.82B INR | ⬆ 22.80% YOY |

| Total Equity | 9.80M INR |

|

| Return on assets | 2.44% | |

| Return on Capital | 3.03% | |

| P/E Ratio | 35.23 | |

| Dividend Yield | 1.80% |

Risks and Challenges For Genus Power Share Price

-

Market Competition: The power infrastructure sector is highly competitive, with many companies vying for a share of the market. This intense competition can put pressure on Genus Power’s pricing and profit margins, potentially affecting its share price.

- Regulatory Changes: Changes in government policies and regulations related to the power sector can impact Genus Power. New rules or compliance requirements could lead to increased costs or operational challenges, influencing the company’s financial performance and share value.

- Economic Slowdown: If there is a slowdown in the economy, the demand for power infrastructure projects might decline. A reduced number of new projects and investments in the power sector could adversely affect Genus Power’s sales and revenue, thereby impacting its share price.

- Technological Changes: The power infrastructure industry is continuously evolving with new technologies. Failure to keep up with these advancements or to innovate could lead Genus Power to lose its competitive edge, which might negatively impact its market position and share price.

-

Dependence on Contracts: A significant portion of Genus Power’s revenue may come from large contracts or projects. Any delay or cancellation of these contracts can disrupt cash flow and profitability, potentially leading to fluctuations in the share price.

Read Also:-

- PCBL Share Price Target

- Zen Technologies Share Price Target

- NIIT Ltd Share Price Target

- Axis Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.