Axis Bank is a well-recognized Indian multinational banking and financial services company. Axis Bank Share Price on NSE as of 29 August 2024 is 1,175.00 INR. On this page, you will find Axis Bank Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Axis Bank share price target on Monday, Axis Bank share price target next week, Will Axis Bank share increase tomorrow, Axis Bank share price target Motilal Oswal, and more Information.

Axis Bank Information

Axis Bank Ltd is one of India’s largest private sector banks, offering a wide range of financial products and services. Established in 1993, the bank provides personal and corporate banking, as well as wealth management, loans, and credit cards. With a strong network of branches and ATMs across the country, Axis Bank is known for its customer-friendly services and innovative banking solutions. The bank’s commitment to technology and digital banking makes it a popular choice among individuals and businesses alike, helping them manage their finances easily and efficiently.

| Official Website | axisbank.com |

| chairperson | Shri Rakesh Makhija |

| CEO | Amitabh Chaudhry (1 Jan 2019–) |

| Founded | 3 December 1993, Ahmedabad |

| Headquarters | Axis House, Mumbai, Maharashtra, India |

| Number of employees | 1,04,633 (2024) |

| Category | Share Price |

Current Market Overview Of Axis Bank Share Price

- Open Price: ₹1,169.00

- High Price: ₹1,179.90

- Low Price: ₹1,163.40

- Market Capitalization: ₹3.64L crore

- Price-to-Earnings (P/E) Ratio: 13.65

- Dividend Yield: 0.085%

- Credit Default Probability (CDP) Score: C

- 52-Week High: ₹1,339.65

- 52-Week Low: ₹951.40

- Current Price: ₹1,175.00

Axis Bank Share Price Recent Graph

Read Also:- REC Share Price Target 2024, 2025 To 2030 and More Details

Axis Bank Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Axis Bank for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Axis Bank Share Price Target Years | SHARE PRICE TARGET |

| 1 | Axis Bank Share Price Target 2024 | ₹1350 |

| 2 | Axis Bank Share Price Target 2025 | ₹1426 |

| 3 | Axis Bank Share Price Target 2026 | ₹1529 |

| 4 | Axis Bank Share Price Target 2027 | ₹1637 |

| 5 | Axis Bank Share Price Target 2028 | ₹1750 |

| 6 | Axis Bank Share Price Target 2029 | ₹1868 |

| 7 | Axis Bank Share Price Target 2030 | ₹1987 |

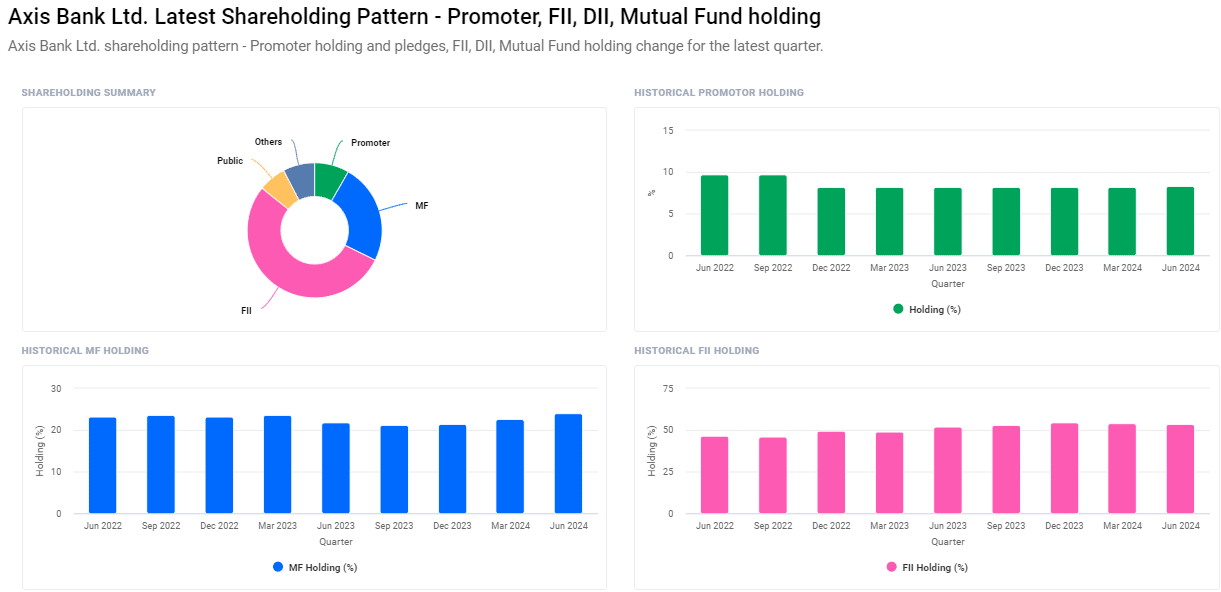

Shareholding Pattern For Axis Bank Share Price

- Foreign Institutions (FII/FPI): 53.43%

- Mutual Funds: 23.98%

- Promoters: 8.31%

- Other Domestic Institutions: 7.65%

- Retail and Others: 6.64%

Factors Affecting Axis Bank Share Price Growth

Here are five key factors that can influence the growth of Axis Bank’s share price:

- Economic Conditions: The overall economic environment plays a significant role in Axis Bank’s performance. A strong economy boosts business activities, leading to increased borrowing and higher profitability for the bank, which positively affects its share price. Conversely, economic downturns can lead to reduced loan demand and increased defaults, putting pressure on the share price.

- Interest Rates: Changes in interest rates directly impact the profitability of banks like Axis Bank. Higher interest rates can increase the bank’s net interest margin, boosting profitability. However, if rates are too high, it might reduce the demand for loans. Low-interest rates, on the other hand, can stimulate borrowing but might reduce the bank’s earnings from loans.

- Regulatory Changes: Banking regulations can affect how Axis Bank operates. Changes in reserve requirements, lending limits, or capital adequacy norms can impact the bank’s profitability and, thus, its share price. Favorable regulatory changes can support growth, while stringent regulations may pose challenges.

- Asset Quality: The quality of loans and advances, also known as asset quality, is crucial for Axis Bank’s financial health. High levels of non-performing assets (NPAs) can reduce profitability and investor confidence, leading to a decline in the share price. Maintaining good asset quality is vital for the bank’s growth and stability.

-

Technological Advancements: Axis Bank’s investment in digital banking and technology can significantly influence its share price. By adopting innovative banking solutions, the bank can attract more customers, improve operational efficiency, and stay competitive. A strong technological edge can lead to better customer experiences and potentially higher profits, driving the share price upward.

Read Also:-

- Chennai Petroleum Share Price Target

- DMart Share Price Target

- Lotus Chocolate Share Price Target

- RBL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.