Zydus Lifesciences Limited is a well-recognized Indian multinational pharmaceutical company. Previously known as Cadila Healthcare Limited. ZYDUS Share Price on NSE as of 28 August 2024 is 1,138.00 INR. On this page, you will find Asian Paints Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Zydus Life share price target today, Zydus Lifesciences News today, Zydus Share price target tomorrow, Zydus life share price target 2025 moneycontrol, and more Information.

Zydus Lifesciences Ltd Company Details

Zydus Lifesciences Ltd is a prominent Indian pharmaceutical company headquartered in Ahmedabad. It specializes in the development, manufacturing, and marketing of a wide range of healthcare products, including generic medicines, over-the-counter drugs, and vaccines. With a strong focus on innovation and quality, Zydus Lifesciences is known for its significant contributions to the pharmaceutical industry, both in India and internationally. The company is dedicated to enhancing global health through advanced and affordable healthcare solutions.

| Official Website | zyduslife.com |

| Founded | 1952 |

| Founder | Ramanbhai Patel |

| Headquarters | Ahmedabad, Gujarat, India |

| Chairman | Pankaj R. Patel |

| Number of employees | 26,921 (2024) |

| Category | Share Price |

Current Market Overview Of ZYDUS Share Price

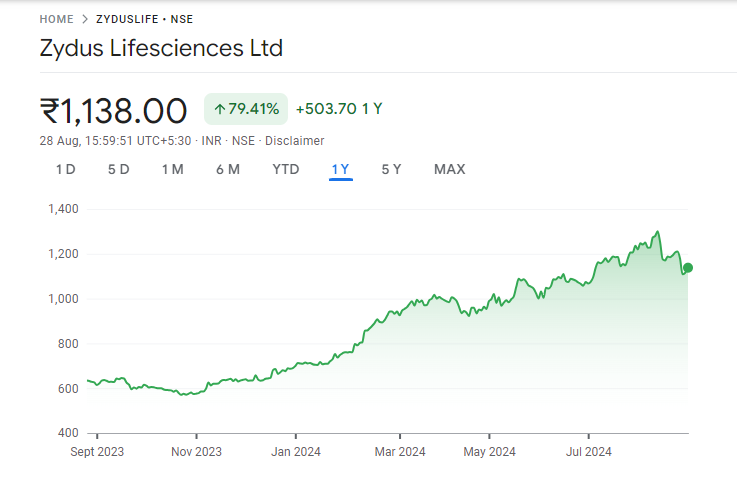

- Open: INR 1,152.00

- High: INR 1,156.00

- Low: INR 1,126.00

- Market Cap: INR 1.15L Cr

- P/E Ratio: 27.41

- Dividend Yield: 0.26%

- 52-Week High: INR 1,324.30

- 52-Week Low: INR 567.75

- Current Price: INR 1,138.00

ZYDUS Share Price Recent Graph

ZYDUS Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of ZYDUS for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | ZYDUS Share Price Target Years | SHARE PRICE TARGET |

| 1 | ZYDUS Share Price Target 2024 | ₹1285 |

| 2 | ZYDUS Share Price Target 2025 | ₹1324 |

| 3 | ZYDUS Share Price Target 2026 | ₹1488 |

| 4 | ZYDUS Share Price Target 2027 | ₹1591 |

| 5 | ZYDUS Share Price Target 2028 | ₹1636 |

| 6 | ZYDUS Share Price Target 2029 | ₹1731 |

| 7 | ZYDUS Share Price Target 2030 | ₹1882 |

Read Also:- AFFLE India Share Price Target 2024, 2025 to 2030 and More Details

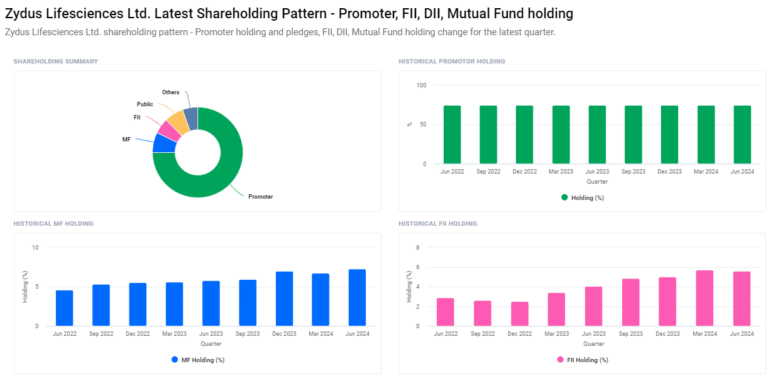

Shareholding Pattern For ZYDUS Share Price

- Promoters: 74.98%

- Mutual Funds: 7.24%

- Retail and Others: 6.80%

- Foreign Institutions: 5.59%

- Other Domestic Institutions: 5.40%

Risks and Challenges to ZYDUS Share Price

Here are four key risks and challenges that could impact Zydus Lifesciences Ltd’s share price:

- Regulatory Challenges: Zydus Lifesciences operates in a highly regulated industry. Any delays or rejections in obtaining regulatory approvals for new drugs can negatively affect the company’s stock performance and market reputation.

- Market Competition: The pharmaceutical sector is highly competitive, with numerous companies vying for market share. Intense competition can put pressure on Zydus to reduce prices or invest heavily in marketing and R&D, impacting its profit margins.

- Patent Expirations: The expiration of patents for key products can lead to increased competition from generic alternatives. This can affect the company’s revenue if competitors launch similar products at lower prices.

-

Economic and Political Uncertainty: Economic downturns and political instability in key markets can disrupt operations and impact financial performance. Fluctuations in currency exchange rates and trade policies may also affect the company’s profitability and stock price.

Factors Driving Growth For ZYDUS Share Price

Here are five key factors driving growth for Zydus Lifesciences Ltd’s share price:

- Strong Product Portfolio: Zydus Lifesciences boasts a diverse range of pharmaceutical products, including generics, over-the-counter medications, and vaccines. A robust and varied product lineup helps the company cater to different market needs and drive revenue growth.

- Innovation and R&D: The company’s commitment to research and development (R&D) is a major growth driver. Zydus invests in developing new and advanced drugs, which can lead to the introduction of novel therapies and increase its competitive edge in the market.

- Global Expansion: Zydus Lifesciences has been expanding its footprint beyond India into international markets. This global presence helps the company tap into new revenue streams and diversify its market risks, contributing positively to its share price.

- Regulatory Approvals: Successful regulatory approvals for new drugs and treatments play a crucial role in boosting investor confidence. Positive news regarding regulatory approvals can lead to increased stock valuations as it opens new revenue opportunities for the company.

-

Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions can enhance Zydus Lifesciences’ capabilities and market reach. By forming partnerships with other pharmaceutical companies or acquiring complementary businesses, the company can strengthen its market position and drive growth.

Read Also:-

- MRPL Share Price Target

- BOI Share Price Target

- JBM Auto Share Price Target

- Thermax Limited Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.