Om Infra is a well-recognized Indian infrastructure company. Om Infra Share Price on NSE as of 27 August 2024 is 206.00 INR. On this page, you will find Om Infra Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Om Infra News, Om Infra share price target tomorrow, Om Infra share price Target 2030 In Hindi, OM Infra Share Price target 2025 Moneycontrol, and more Information.

Om Infra Ltd Company Details

Om Infra Ltd is an Indian company specializing in engineering, procurement, and construction (EPC) projects, particularly in the infrastructure sector. Founded in 1971 and headquartered in New Delhi, Om Infra Ltd focuses on a variety of projects, including water management, hydroelectric power, and irrigation systems.

The company is known for its expertise in building large-scale dams, canals, and other water-related infrastructure, helping to support agricultural and power needs across the country. With a commitment to quality and sustainable development, Om Infra Ltd continues to play an important role in India’s infrastructure growth.

| Official Website | ommetals.com |

| Headquarters | India |

| Number of employees | 432 (2023) |

| Subsidiaries | Bihar Logistics Private Limited, Om Kothari Pariwarik Trust, Gurha Termal Power Company Limited, West Bengal Logistics Private Limited, More |

| Category | Share Price |

Current Market Overview Of OM Infra Share Price

- Open: ₹212.99

- High: ₹213.00

- Low: ₹204.50

- Market Cap: ₹1.97K crore

- P/E Ratio: 44.95

- Dividend Yield: N/A

- 52-Week High: ₹227.90

- 52-Week Low: ₹60.50

OM Infra Share Price Recent Graph

Read Also:- SJVN Share Price Target 2024, 2025, 2026 to 2030 Prediction

OM Infra Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Om Infra for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Om Infra Share Price Target Years | SHARE PRICE TARGET |

| 1 | Om Infra Share Price Target 2024 | ₹290 |

| 2 | Om Infra Share Price Target 2025 | ₹370 |

| 3 | Om Infra Share Price Target 2026 | ₹431 |

| 4 | Om Infra Share Price Target 2027 | ₹558 |

| 5 | Om Infra Share Price Target 2028 | ₹671 |

| 6 | Om Infra Share Price Target 2029 | ₹773 |

| 7 | Om Infra Share Price Target 2030 | ₹857 |

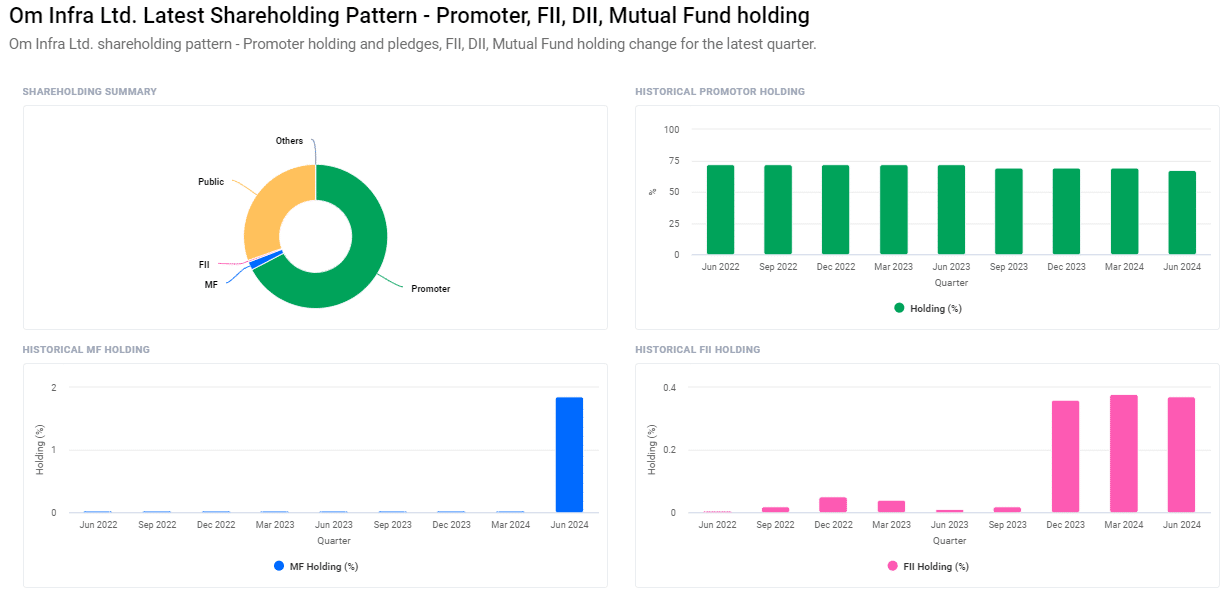

Shareholding Pattern For OM Infra Share Price

- Promoters: 67.33%

- Retail and Others: 30.44%

- Mutual Funds: 1.86%

- Foreign Institutions: 0.37%

Factors Affecting OM Infra Share Price Share Price

-

Infrastructure Project Contracts: OM Infra’s share price is heavily influenced by the number and size of new contracts it secures. Winning large, high-value projects can boost investor confidence and positively impact the share price while losing out on major contracts can have the opposite effect.

- Government Policies and Spending: As a company involved in infrastructure development, OM Infra is affected by government policies and spending on infrastructure projects. Increased government investment in sectors like water management, power, and irrigation can lead to more business opportunities for the company, potentially driving up its share price.

- Economic Conditions: General economic conditions play a key role in influencing OM Infra’s share price. A strong economy with higher industrial growth can lead to increased demand for infrastructure projects, benefiting the company, while economic downturns might reduce spending and affect the company’s earnings.

- Raw Material Costs: The cost of raw materials such as steel, cement, and other construction supplies can impact OM Infra’s profit margins. Fluctuations in these costs can affect the company’s overall profitability, thereby influencing its share price.

- Technological Advancements: Innovations and advancements in construction technology can enhance OM Infra’s operational efficiency and project execution capabilities. Being at the forefront of technology can improve profitability and attract investor interest, positively affecting the share price.

-

Competition in the Industry: The level of competition within the infrastructure and EPC sector can impact OM Infra’s market share and pricing power. Strong competition may lead to tighter profit margins, while a dominant market position can provide a competitive edge, influencing the share price accordingly.

Read Also:-

- Anant Raj Share Price Target

- KPI Green Share Price Target

- Angel One Share Price Target

- RHFL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.