Delhivery is a well-known Indian logistics and supply chain company. Delhivery Share Price on NSE as of 27 August 2024 is 427.30 INR. On this page, you will find Delhivery Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as DELHIVERY share price screener, Delhivery share hold or sell, Delhivery share News today, Delhivery share price target tomorrow, Delhivery share price target 2030, and more Information.

Delhivery Company Details

Delhivery is a prominent logistics and supply chain company based in India, specializing in e-commerce and transportation solutions. Founded in 2011, Delhivery has grown rapidly to become one of the leading logistics firms in the country. The company offers a wide range of services, including express parcel delivery, freight logistics, warehousing, and cross-border solutions.

Delhivery is known for its extensive network, innovative technology, and efficient delivery services, making it a preferred partner for businesses of all sizes looking to streamline their supply chain operations. With a focus on reliability and customer satisfaction, Delhivery continues to expand its reach across India.

| Official Website | delhivery.com |

| CEO | Sahil Barua (May 2011–) |

| Founded | May 2011 |

| Founders | Sahil Barua, Kapil Bharati, Suraj Saharan, Bhavesh Manglani, Mohit Tandon |

| Headquarters |

Gurgaon, Haryana, India

|

| Number of employees | 23,381 (2024) |

| Category | Share Price |

Current Market Overview Of Delhivery Share Price

- Open: 431.90 INR

- High: 432.00 INR

- Low: 425.15 INR

- Market Cap: 31.60K Cr

- P/E Ratio: N/A

- Dividend Yield: N/A

- 52-Week High: 488.00 INR

- 52-Week Low: 354.20 INR

Delhivery Share Price Recent Graph

Read Also:- Aarti Drugs Share Price Target 2024, 2025, 2026 to 2030 Prediction

Delhivery Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Delhivery for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Delhivery Share Price Target Years | SHARE PRICE TARGET |

| 1 | Delhivery Share Price Target 2024 | ₹562 |

| 2 | Delhivery Share Price Target 2025 | ₹592 |

| 3 | Delhivery Share Price Target 2026 | ₹679 |

| 4 | Delhivery Share Price Target 2027 | ₹776 |

| 5 | Delhivery Share Price Target 2028 | ₹887 |

| 6 | Delhivery Share Price Target 2029 | ₹1015 |

| 7 | Delhivery Share Price Target 2030 | ₹1162 |

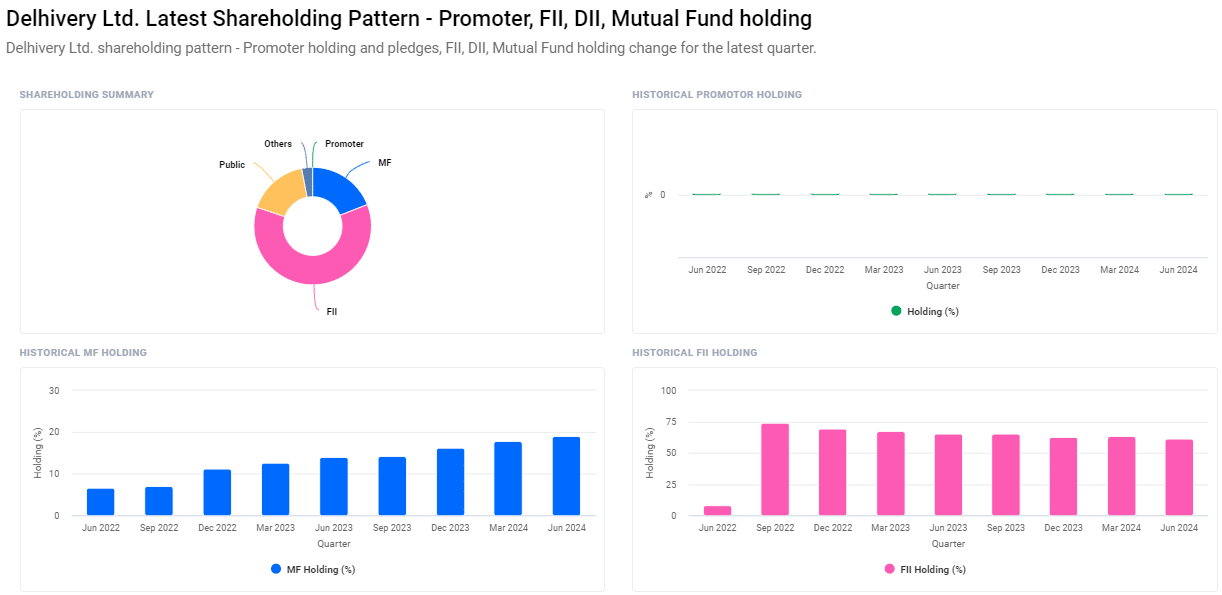

Shareholding Pattern For Delhivery Share Price

- Foreign Institutions: 61.16%

- Mutual Funds: 19.05%

- Retail and Others: 16.81%

- Other Domestic Institutions: 2.97%

Major Factors Affecting Delhivery Share Price Share Price

-

Market Demand for E-commerce: As a logistics provider heavily involved in e-commerce, Delhivery’s share price is influenced by the growth and demand in the online shopping sector. An increase in e-commerce sales can boost the company’s revenue and positively impact its share price.

- Operational Efficiency: Delhivery’s ability to maintain efficient delivery services and manage costs effectively directly impacts its profitability. High operational efficiency can lead to better profit margins, which investors often view favorably, boosting the share price.

- Technological Advancements: As a technology-driven logistics company, Delhivery’s investments in cutting-edge technology, such as automation and AI, can improve its service quality and customer satisfaction. Successful tech integration can enhance investor confidence and drive up the share price.

- Expansion and Growth Plans: Delhivery’s plans for expansion, both within India and internationally, can influence its share price. Successful market expansion and the introduction of new services can attract more customers and investors, positively affecting the share price.

- Economic Conditions: The overall economic environment plays a significant role in Delhivery’s performance. Economic stability and growth can increase demand for logistics services, while economic downturns can reduce business activity and impact the share price negatively.

-

Competition: The logistics and supply chain industry is highly competitive. Delhivery’s ability to stay ahead of competitors through innovation, customer service, and pricing strategies can influence its market position and, subsequently, its share price.

Read Also:-

- KPI Green Share Price Target

- Anant Raj Share Price Target

- Sealmatic Share Price Target

- Integra Essentia Ltd. Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.