Kotak Mahindra Bank is an Indian banking and financial services company. Kotak Mahindra Bank Share Price on NSE as of 27 August 2024 is 1,804.25 INR. On this page, you will find Kotak Mahindra Bank Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Kotak Bank share News today, Kotak Bank Latest News today, Why Kotak Bank share is falling Today, Kotak Mahindra Bank share price target tomorrow, Kotak Mahindra Bank share price target 2030, and more Information.

Kotak Mahindra Bank Ltd Details

Kotak Mahindra Bank Ltd is one of India’s leading private sector banks, known for its comprehensive range of financial services. Founded in 1985 and headquartered in Mumbai, the bank offers a variety of services, including personal banking, corporate banking, investment banking, and wealth management. Kotak Mahindra Bank is well-regarded for its customer service, innovative banking solutions, and strong financial performance. Over the years, it has grown to become a trusted name in the banking industry, serving millions of customers across India with reliability and excellence.

| Official Website | kotak.com |

| CEO | Ashok Vaswani (1 Jan 2024–) |

| Founded | 21 November 1985 |

| Founder | Uday Kotak |

| Headquarters | Mumbai, Maharashtra, India |

| Number of employees | 1,16,000 (2024) |

| Category | Share Price |

Current Market Overview Of Kotak Mahindra Bank Share Price

- Open – 1,811.05

- High – 1,813.10

- Low – 1,791.70

- Mkt cap – 3.59LCr

- P/E ratio – 16.65

- Div yield – 0.11%

- 52-wk high – 1,926.50

- 52-wk low – 1,543.85

Kotak Mahindra Bank Share Price Recent Graph

Read Also:- RBL Share Price Target 2024, 2025 To 2030 Prediction

Kotak Mahindra Bank Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Kotak Mahindra Bank for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Kotak Mahindra Bank Share Price Target Years | SHARE PRICE TARGET |

| 1 | Kotak Mahindra Bank Share Price Target 2024 | ₹1900 |

| 2 | Kotak Mahindra Bank Share Price Target 2025 | ₹1995 |

| 3 | Kotak Mahindra Bank Share Price Target 2026 | ₹2185 |

| 4 | Kotak Mahindra Bank Share Price Target 2027 | ₹2276 |

| 5 | Kotak Mahindra Bank Share Price Target 2028 | ₹2389 |

| 6 | Kotak Mahindra Bank Share Price Target 2029 | ₹2509 |

| 7 | Kotak Mahindra Bank Share Price Target 2030 | ₹2612 |

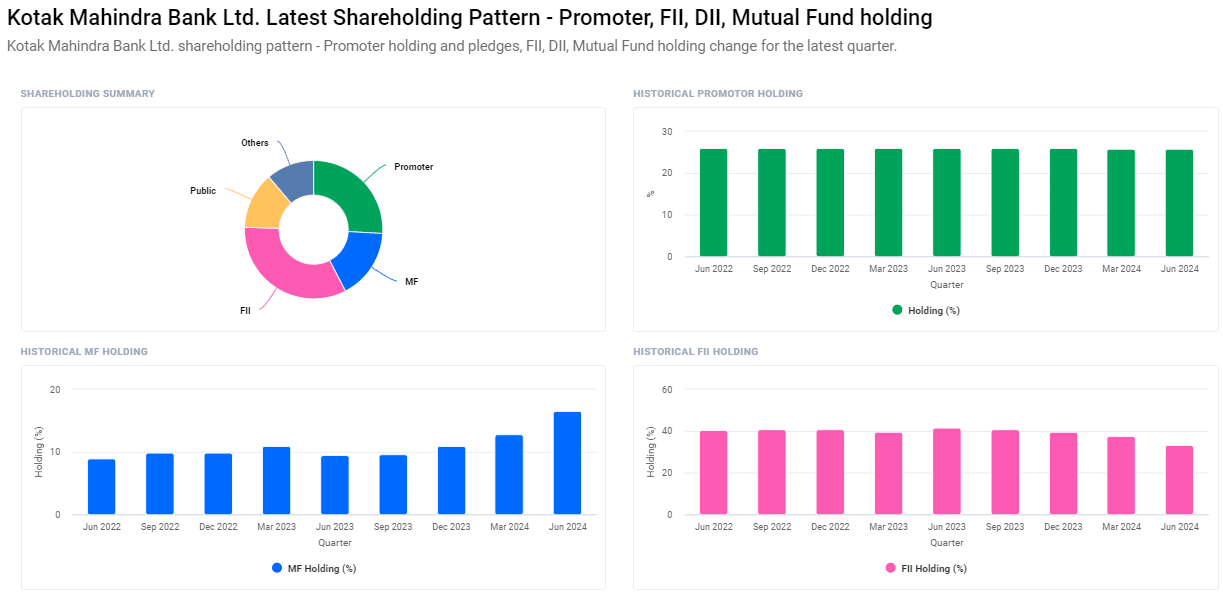

Shareholding Pattern For Kotak Mahindra Bank Share Price

- Foreign Institutions: 33.16%

- Promoters: 25.89%

- Mutual Funds: 16.52%

- Retail and Others: 13.22%

- Other Domestic Institutions: 11.21%

Risks and Challenges to Kotak Mahindra Bank Share Price

-

Economic Slowdown: An economic slowdown or recession can negatively impact Kotak Mahindra Bank’s share price. Reduced economic activity can lead to lower demand for loans and other banking services, affecting the bank’s profitability and share value.

- Regulatory Changes: Changes in banking regulations and government policies can pose risks to Kotak Mahindra Bank. Stricter regulations or changes in compliance requirements can increase operational costs and impact profitability, which may lead to a drop in share prices.

- Credit Risk: The risk of loan defaults is a significant challenge for banks, including Kotak Mahindra Bank. High levels of non-performing assets (NPAs) can impact the bank’s financial health, reducing investor confidence and leading to a decline in share prices.

- Competition: The banking sector is highly competitive, with numerous players vying for market share. Increased competition from other private sector banks, public sector banks, and fintech companies can pressure Kotak Mahindra Bank’s profitability and affect its share price.

-

Interest Rate Fluctuations: Changes in interest rates can impact Kotak Mahindra Bank’s margins and profitability. Rising interest rates can increase the cost of borrowing for customers, leading to reduced loan demand, while falling interest rates can reduce the bank’s interest income, both of which can influence the bank’s share price.

Read Also:-

- Sun TV Share Price Target

- Filatex Share Price Target

- Rattan Power Share Price Target

- REC Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.