REC is a public-sector financial company. REC Share Price on NSE as of 26 August 2024 is 589.90 INR. On this page, you will find REC Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as REC Share Price Target 2040, REC share News, Rec share price target tomorrow, REC Share Price Target 2025 Moneycontrol, REC Share Price Target 2030, and more Information.

REC Limited Company Details

REC Limited, formerly known as Rural Electrification Corporation Limited, is a public-sector financial company based in India. It specializes in providing financing for the development of power infrastructure projects, including rural electrification and power generation. REC Limited supports various projects aimed at improving electricity access and promoting energy efficiency across the country. By offering loans and financial assistance to power sector companies, REC plays a crucial role in enhancing the nation’s power infrastructure and supporting economic growth.

| Official Website | recindia.nic.in |

| REC Full Form | Rural Electrification Corporation |

| Founded | 25 July 1969 |

| Headquarters | Core-4, SCOPE Complex, 7, Lodhi Road,

New Delhi, Delhi, India

|

| CMD | Vivek Kumar Dewagan |

| Number of employees | 512 (2024) |

| Parent organization | Power Finance Corp |

| Category | Share Price |

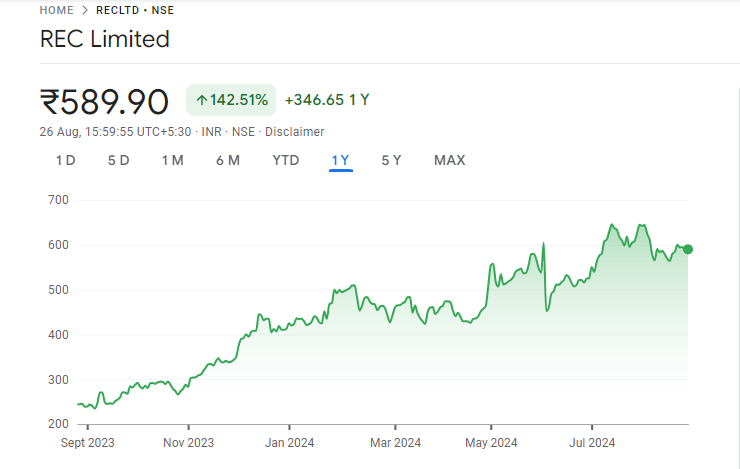

Current Market Overview Of REC Share Price

- Open: ₹598.05

- High: ₹598.90

- Low: ₹587.10

- Market Cap: ₹1.55 Lakh Crores

- P/E Ratio: 10.61

- Dividend Yield: 2.80%

- 52-Week High: ₹654.00

- 52-Week Low: ₹230.55

REC Share Price Recent Graph

Read Also:- Biocon Share Price Target 2024, 2025, 2026, 2027 to 2030 Forecast

REC Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of REC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | REC Share Price Target Years | SHARE PRICE TARGET |

| 1 | REC Share Price Target 2024 | ₹733 |

| 2 | REC Share Price Target 2025 | ₹1120 |

| 3 | REC Share Price Target 2026 | ₹1283 |

| 4 | REC Share Price Target 2027 | ₹1468 |

| 5 | REC Share Price Target 2028 | ₹1679 |

| 6 | REC Share Price Target 2029 | ₹1923 |

| 7 | REC Share Price Target 2030 | ₹2199 |

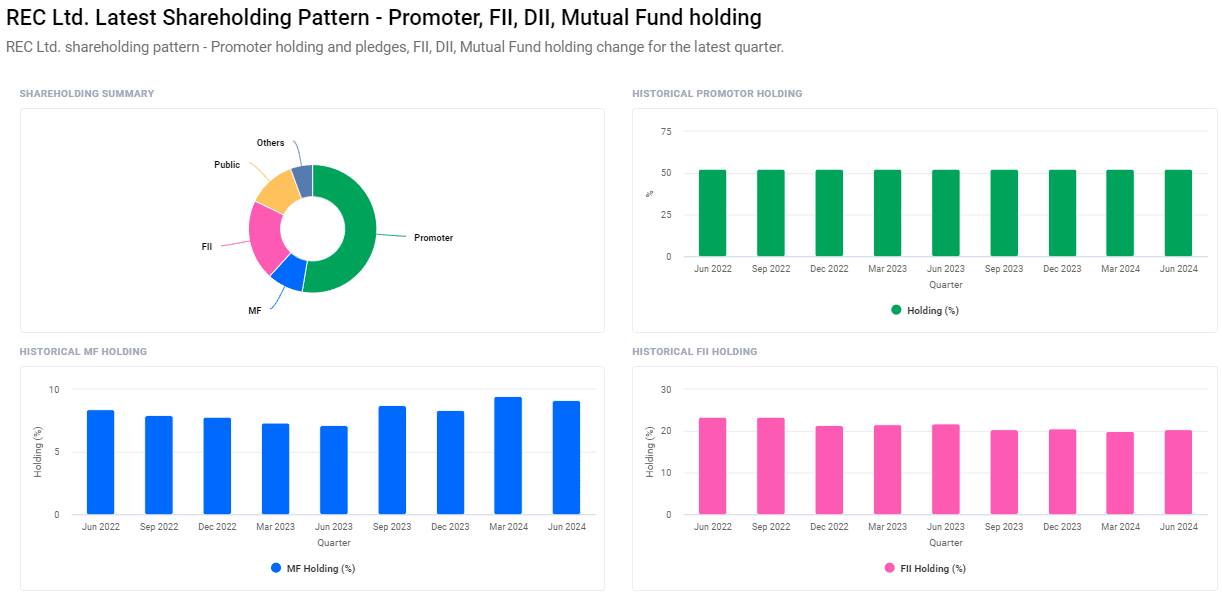

Share Holding Pattern For REC Share Price

- Promoters: 50.63%

- Foreign Institutions (FII/FPI): 20.43%

- Retail and Others: 12.26%

- Mutual Funds: 9.11%

- Other Domestic Institutions: 5.56%

Read Also:- Motherson Sumi Share Price Target 2024, 2025, 2026 To 2030 Forecast

REC Ltd Financials 2023

| Revenue | 189.49B INR | ⬆ 20.95% YOY |

| Operating expense | 6.38B INR | ⬆ 13.83% YOY |

| Net Income | 141.45B INR | ⬆ 26.67% YOY |

| Net Profit Margin | 74.65 | ⬆ 4.73% YOY |

| Earnings Per Share | 53.11 | ⬆ 26.88% YOY |

| EBITDA |

|

|

| Effective Tax Rate | 21.24% |

|

| Total Assets | 5.48T INR | ⬆ 17.76% YOY |

| Total Liabilities | 4.79T INR | ⬆ 17.54% YOY |

| Total Equity | 693.50B INR |

|

| Return on assets | 2.79% | |

| Return on Capital |

|

|

| P/E Ratio | 9.85 | |

| Dividend Yield |

|

REC LTD Competitors (Market Cap: 142,483.75 crores INR)

- Power Finance Market Cap: 150,088.63 cr INR

- SBI Card Market Cap: 67,875.56 cr INR

- IFCI Market Cap: 14,609.97 cr INR

- Ujjivan Financial Market Cap: 7,179.21 cr INR

Risks and challenges to REC Share Price

- Regulatory Changes: Changes in government policies or regulations related to the power sector or financial institutions can influence REC’s operations. New compliance requirements or policy shifts could increase operational costs or affect project financing, impacting share performance.

- Interest Rate Fluctuations: REC’s financial performance can be affected by changes in interest rates. Rising rates could increase borrowing costs and affect the cost of funding for projects while falling rates might impact interest income, both of which could influence the share price.

- Economic Conditions: Broader economic conditions, such as economic slowdowns or fluctuations in economic growth, can affect REC’s business. Economic instability may lead to reduced demand for power projects or delays in project completion, impacting revenue and share price.

- Project Execution Risks: The success of REC’s investments relies on the successful execution of power projects. Delays, cost overruns, or failures in project implementation can affect the return on investment and financial stability, potentially impacting the share price.

- Credit Risk: REC Limited provides loans to power sector projects, and if borrowers default or face financial difficulties, it can impact REC’s financial health. High levels of non-performing assets (NPAs) could affect profitability and, in turn, the share price.

Read Also:-

- Hondapower Share Price Target

- Maharashtra Bank Share Price Target

- Rail Vikas Nigam Share Price Target

- Tata Power Share Price Target

- IRCON Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.