DMart is a leading Indian retail company that runs a network of supermarkets and hypermarkets, offering a wide range of products under one roof. DMart Share Price on NSE as of 24 August 2024 is 4,898.85 INR. On this page, you will find DMart Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as DMART share price target tomorrow, Avenue share price, Dmart share price target 2040, DMart share price Target 2030, and more Information.

Avenue Supermarts ltd (DMart) Company Details

Avenue Supermarts Ltd, commonly known as DMart, is a popular Indian retail company that operates a chain of hypermarkets and supermarkets. Founded by Radhakishan Damani in 2002, DMart focuses on offering a wide range of products, including groceries, household items, and apparel, at competitive prices. Known for its efficient operations and customer-centric approach, DMart has grown rapidly across India, becoming a trusted name for quality and affordability in the retail sector.

| Official Website | dmartindia.com |

| Founded | 15 May 2002 |

| Founder | Radhakishan Damani |

| Headquarters | Powai, Mumbai, Maharashtra, India |

| CEO | Ignatius Navil Noronha |

| Number of employees | 13,971 (2024) |

| Category | Share Price |

Current Market Overview of DMart Share Price

- Open: 5,045.00

- High: 5,088.80

- Low: 4,895.00

- Mkt cap: 3.19LCr

- P/E ratio: 120.35

- Div yield: N/A

- 52-wk high: 5,219.00

- 52-wk low: 3,530.05

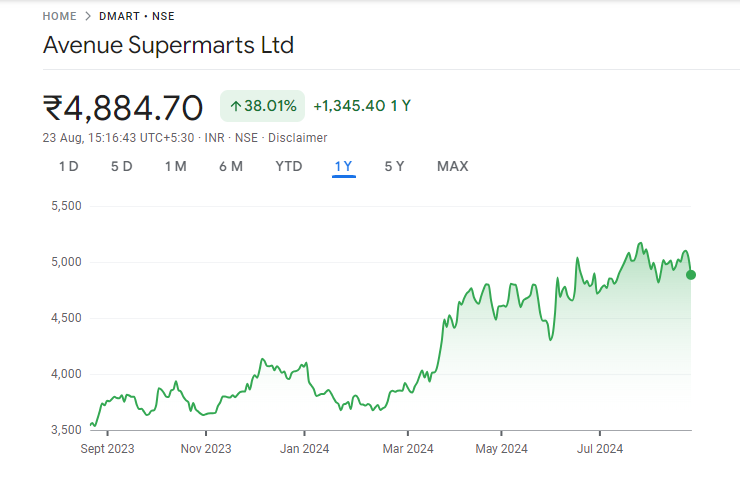

DMart Share Price Recent Graph

DMart Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of DMart for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| S. No. | DMart Share Price Target Years | SHARE PRICE TARGET |

| 1 | DMart Share Price Target 2024 | ₹5294 |

| 2 | DMart Share Price Target 2025 | ₹5823 |

| 3 | DMart Share Price Target 2026 | ₹6636 |

| 4 | DMart Share Price Target 2027 | ₹7627 |

| 5 | DMart Share Price Target 2028 | ₹8727 |

| 6 | DMart Share Price Target 2029 | ₹9989 |

| 7 | DMart Share Price Target 2030 | ₹11431 |

Read Also:- TV18 Share Price Target 2024, 2025, 2026, 2027 to 2030 and More Details

Avenue Supermarts ltd (DMart) Financials

| Market Capitalization Value | 316366.90 crores |

| Total Share Capital | 650.73 crores |

| Total Borrowings | 459.75 crores |

| Trade Payables | 952.76 crores |

| Trade Receivables | 393.34 crores |

| Total Investments | 1064.17 crores |

| Total Inventories | 393.34 crores |

| Total Assets | 21566.12 crores |

| Total Revenue | 49722.00 crores |

| ROE | 13.97 percent |

| ROCE | 18.56 percent |

| PE ratio | 26.27 percent |

| PB ratio | 16.92 percent |

| DE ratio | 0.03 percent |

| Dividend Yield ratio | 0.01 percent |

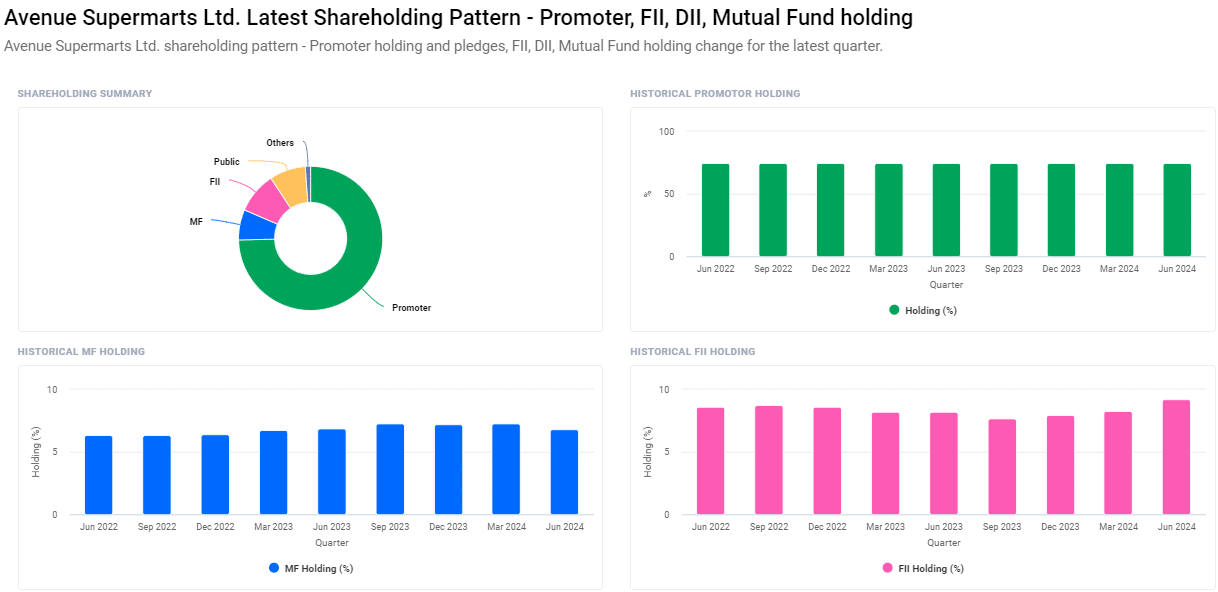

Avenue Supermarts ltd (DMart) Shareholding Pattern

| Shareholders | Share Percentage |

| Promoters | 74.65% |

| Retail and others | 8.10% |

| FII | 9.22% |

| Mutual Funds | 6.81% |

| DII | 1.22% |

Factors Affecting DMart Share Price

-

Sales and Revenue Growth: DMart’s share price is significantly affected by its sales and revenue performance. Consistent growth in these areas, driven by increased customer footfall and higher average spending per customer, positively impacts the share price.

- Expansion Plans: The opening of new stores and expansion into new locations can boost investor confidence. When DMart successfully opens more outlets and taps into new markets, it is seen as a sign of future growth potential, which can lead to an increase in its share price.

- Consumer Spending Trends: The overall economic environment and consumer spending habits play a crucial role. During times of economic prosperity, when people are more willing to spend, DMart may see higher sales, positively influencing its share price.

- Competition in the Retail Sector: The level of competition from other retail giants can impact DMart’s market share and profitability. Strong competition might pressure DMart’s margins, which could affect its share price.

-

Operational Efficiency: DMart’s ability to manage costs and maintain efficient supply chains contributes to its profitability. Effective cost management and streamlined operations lead to better profit margins, making the company more attractive to investors and potentially driving up the share price.

Read Also:-

- Doms Share Price Target

- JP Associates Share Price Target

- DLF Share Price Target

- Hondapower Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.