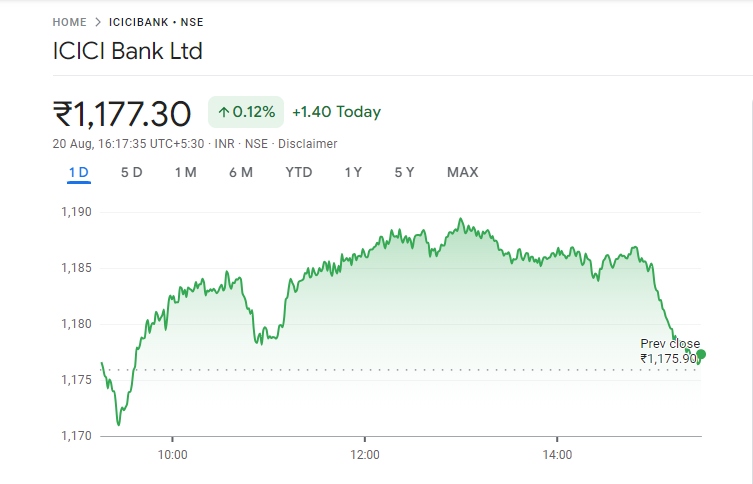

Hello friends, Do you want to know about the future value of ICIC Bank share price target? So you have come to the right page. ICIC Bank is an Indian multinational bank and financial services company. ICICI Bank Share Price on NSE as of 20 August 2024 is 1,177.30 INR. On this page, you will find ICIC Bank Share Price Target 2024, 2025, 2026 to 2030 as well as Why ICICI Bank share is falling today, ICICI Bank share price target tomorrow, ICICI Bank share price Target 2030, ICICI Bank Share Price target tomorrow Moneycontrol, and more Information.

ICIC Bank Details

ICICI Bank is one of India’s largest and most respected private sector banks. Founded in 1994, it offers a wide range of financial services, including personal and corporate banking, insurance, and investment products. Known for its strong digital banking platform and customer-focused services, ICICI Bank has a significant presence both in India and internationally. With its commitment to innovation and growth, the bank plays a key role in shaping the future of Indian banking.

| Official Website | icicibank.com |

| CEO | Sandeep Bakhshi (15 Oct 2018–) |

| Founded | 1994, Vadodara |

| Founder | Industrial Credit and Investment Corporation of India |

| Chairman |

Girish Chandra Chaturvedi |

| Headquarters | Mumbai, Maharashtra, India |

| Number of employees | 1,87,765 (2024) |

| Category | Share Price |

Overview of ICIC Bank Share Price

- Open: 1,174.20

- High: 1,189.80

- Low: 1,170.00

- Mkt cap: 8.31LCr

- P/E ratio: 18.55

- Div yield: 0.85%

- CDP score: C

- 52-wk high: 1,257.80

- 52-wk low: 899.00

ICIC Bank Share Price Recent Graph

ICIC Bank Share Price Target Tomorrow

Here are the estimated share prices of ICIC Bank for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| ICIC Bank Share Price Target Years | Target Price |

| ICIC Bank Share Price Target 2024 | 1,257 |

| ICIC Bank Share Price Target 2025 | 1,335 |

| ICIC Bank Share Price Target 2026 | 1,455 |

| ICIC Bank Share Price Target 2027 | 1,575 |

| ICIC Bank Share Price Target 2028 | 1,669 |

| ICIC Bank Share Price Target 2029 | 1,866 |

| ICIC Bank Share Price Target 2030 | 2,035 |

Read Also:- HDFC Bank Share Price Target 2024, 2025 to 2030 and More Details

Shareholding Pattern of ICIC Bank Share Price

- Foreign Institutions: 45.47%

- Mutual Funds: 29.18%

- Other Domestic Institutions: 15.52%

- Retail And Others: 9.83%

ICICI BANK: NSE Financials 2023

| Revenue | 1.17 Trillion INR | ⬆ 18.16% YOY |

| Operating expense | 824.39 Billion INR | ⬆ 12.70% YOY |

| Net Income | 340.37 Billion INR | ⬆ 35.55% YOY |

| Net Profit Margin | 29.12 | ⬆ 14.74% YOY |

| Earnings Per Share | 47.84 | ⬆ 45.06% YOY |

| EBITDA |

|

|

| Effective Tax Rate |

|

|

| Total Assets | 19.58 Billion INR | ⬆ 11.75% YOY |

| Total Liabilities | 17.37 Billion INR | ⬆ 11.04% YOY |

| Total Equity | 2.21 Billion INR | |

| Return on assets | 1.91% | |

| Return on Capital |

|

Factors Affecting ICIC Bank Share Price

-

Interest Rates: Changes in interest rates set by the Reserve Bank of India (RBI) can significantly impact ICICI Bank’s profitability. Higher interest rates can increase the bank’s net interest margin, boosting earnings, while lower rates can compress margins and affect the share price.

- Economic Conditions: The overall health of the economy plays a vital role in influencing ICICI Bank’s share price. Economic growth can lead to higher loan demand and better asset quality, while economic downturns can result in increased non-performing assets (NPAs) and lower profitability.

- Regulatory Changes: Government and RBI regulations regarding banking practices, capital requirements, and lending norms can affect ICICI Bank’s operations. Favorable regulations can support growth, while stricter rules may limit profitability and impact the share price.

- Financial Performance: The bank’s quarterly and annual financial results, including revenue, profit, loan growth, and asset quality, are key determinants of its share price. Consistent performance exceeding market expectations can drive the share price higher.

-

Market Sentiment: Investor confidence and overall market trends also influence ICICI Bank’s share price. Positive sentiment in the banking sector or favorable global market conditions can push the stock higher, while negative sentiment or market volatility can lead to a decline.

Read Also:-

- SBI Share Price Target

- IDFC First Bank Share Price Target

- Maharashtra Bank Share Price Target

- South Indian Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.