Indus Towers Limited is a leading Indian company that provides vital telecommunications infrastructure. Specializing in passive infrastructure services, Indus Towers supports mobile network operators and other wireless service providers, ensuring seamless connectivity across the nation.

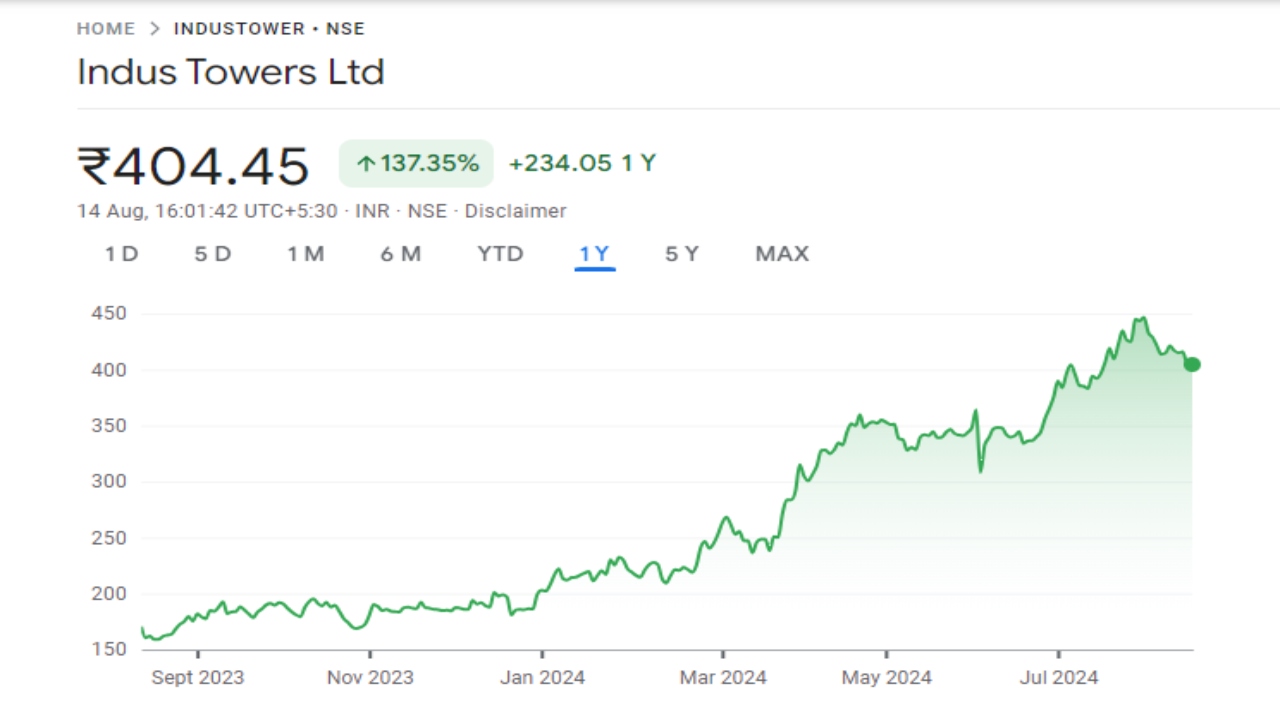

Indus Towers share price on NSE as of 14 August 2024 is 404.45 INR. On this page, you will find Indus Towers Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Indus tower apply, Indus Towers share News today, Vodafone Idea Indus Towers share price target, Indus Towers share price target tomorrow, Indus towers share price target 2030, and more Information.

Indus Towers Ltd Company Details

Indus Towers Ltd is one of India’s largest telecommunications infrastructure companies. It provides essential tower and network solutions, helping telecom operators deliver reliable connectivity across the country. With a vast network of towers, Indus Towers plays a crucial role in supporting India’s digital growth.

The company is dedicated to innovation and sustainability, aiming to improve communication infrastructure while minimizing its environmental impact. Indus Towers is a key player in the telecom industry, contributing to the nation’s expanding digital landscape.

| Official Website | industowers.com |

| Founded | November 2007 |

| Headquarters | DLF Cyber City, Gurugram, Haryana, India |

| Key people |

|

| Number of employees | 3,554 (FY24) |

| Category | Share Price |

Overview of Indus Towers Share Price

- MARKET CAP: ₹1.09LCr

- OPEN: ₹406.45

- HIGH: ₹410.95

- LOW: ₹405.45

- P/E RATIO: 16.48

- DIVIDEND YIELD: N/A

- 52 WEEK HIGH: ₹453.30

- 52 WEEK LOW: ₹157.35

Read Also:- Rajnandini Metal Share Price Target 2024, 2025 to 2030 and More Information

Indus Towers Share Price Target Tomorrow (2024-2030)

Here are the estimated share prices of Indus Towers for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| Indus Towers Share Price Target Years | SHARE PRICE TARGET |

| Indus Towers Share Price Target 2024 | ₹483 |

| Indus Towers Share Price Target 2025 | ₹523 |

| Indus Towers Share Price Target 2026 | ₹576 |

| Indus Towers Share Price Target 2027 | ₹625 |

| Indus Towers Share Price Target 2028 | ₹725 |

| Indus Towers Share Price Target 2029 | ₹850 |

| Indus Towers Share Price Target 2030 | ₹986 |

Indus Towers Share Price Recent Graph

Read Also:- Mazagon Dock Share Price Target 2024, 2025, 2026 to 2030 and More Information

Indus Towers Ltd. Shareholding Pattern

- Promoters: 52.01%

- Foreign Institutions: 23.15%

- Mutual Funds: 12.70%

- Retail And Others: 7.85%

- Other Domestic Institutions: 4.28%

Factors Affecting Indus Towers Share Price Target

-

Telecom Industry Growth

The overall growth of the telecom industry directly impacts Indus Towers’ share price. As demand for mobile and internet services increases, so does the need for telecom infrastructure. Expansion in 4G and 5G networks can boost the company’s business, positively influencing its share price. - Regulatory Environment

Changes in government regulations and policies related to the telecom sector can significantly affect Indus Towers. Favorable regulations can lead to growth opportunities, while stricter policies or legal challenges might negatively impact the company’s performance and its stock value. - Partnerships and Contracts

Indus Towers’ ability to secure long-term contracts with major telecom operators is crucial. Successful partnerships with key players in the industry can ensure steady revenue streams, positively affecting the share price target. - Technology Advancements

As the telecom sector evolves with new technologies like 5G, Indus Towers’ capacity to adapt and upgrade its infrastructure is essential. Staying ahead of technological changes can help the company maintain its market position, positively influencing investor confidence and share price. - Market Competition

The level of competition within the telecom infrastructure industry can affect Indus Towers’ market share and profitability. Strong competition might pressure pricing and margins, potentially impacting the company’s stock performance. - Economic Conditions

The overall economic environment, including interest rates, inflation, and GDP growth, can influence the stock market and Indus Towers’ share price. In a strong economy, business expansion and increased consumer spending on telecom services can boost the company’s performance. -

Financial Performance

Indus Towers’ quarterly and annual financial results, including revenue growth, profit margins, and debt levels, play a crucial role in determining its share price. Strong financial health can lead to a higher share price target, while weaker performance might lower investor expectations.

Read Also:-

- Tech Mahindra Share Price Target

- SRF Share Price Target

- IEX Share Price Target

- RCF Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.