Unitech Ltd is an Indian real estate and was once recognized as one of the largest real estate developers in India. Unitech share price on NSE as of 20 September 2024 is 10.95 INR. On this page, you will find Unitech Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as NSE Unitech share price target, Unitech share price target tomorrow, Unitech Share Price Target 2040, Unitech share price target 2030, and more Information.

Unitech Ltd. Details

Unitech Ltd is an established real estate developer in India, founded in 1971. The company has been involved in creating residential complexes, commercial spaces, and IT parks across the country. Known for its large-scale projects, Unitech has made a significant impact on India’s urban landscape. Although the company has faced some challenges in recent years, it remains a recognized name in the real estate industry, reflecting its long history and contribution to development in India.

| Official Website | unitechgroup.com |

| Founded | 1972 |

| Founder | Ramesh Chandra |

| Headquarters | New Delhi, Gurugram |

| Executive Chairman | Yudhvir Malik |

| Number of employees | 213 (2023) |

| Category | Share Price |

Unitech Share Price Target Tomorrow

Here are the estimated share prices of Unitech for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

- 2024 – ₹18.5

- 2025 – ₹27.4

- 2026 – ₹29.9

- 2027 – ₹34.5

- 2028 – ₹38.4

- 2029 – ₹44.3

- 2030 – ₹56.1

Current Market Overview of Unitech Share Price

- MARKET CAP: ₹2.87KCr

- Current Price: ₹10.95

- OPEN: ₹10.74

- HIGH: ₹10.95

- LOW: ₹10.40

- P/E RATIO:

- DIVIDEND YIELD: NA

- 52 WEEK HIGH: ₹18.50

- 52 WEEK LOW: ₹2.20

Read Also:- Tata Power Share Price Target 2024, 2025, 2026 to 2030 Forecast

Unitech Share Price Recent Graph

Read Also:- Rail Vikas Nigam Share Price Target 2024, 2025 to 2030 Forecast

Unitech Ltd Financials (2023)

| Revenue | 4.06 Billion INR | ⬇ -23.98% YOY |

| Operating expense | 1.62 Billion INR | ⬆ 26.41% YOY |

| Net Income | -27.88 Billion INR | ⬇ -175.47% YOY |

| Net Profit Margin | -687.42 | ⬇ -262.39% YOY |

| Earnings Per Share |

|

|

| EBITDA | -277.93 | ⬆ 9.35% |

| Effective Tax Rate | 0.34% |

|

| Total Assets | 268.86 Billion INR | ⬆ 0.57% YOY |

| Total Liabilities | 280.52 Billion INR | ⬆ 13.46% YOY |

| Total Equity | -11.40 Billion INR |

|

| Return on assets | -0.08% | |

| Return on Capital | -0.28% |

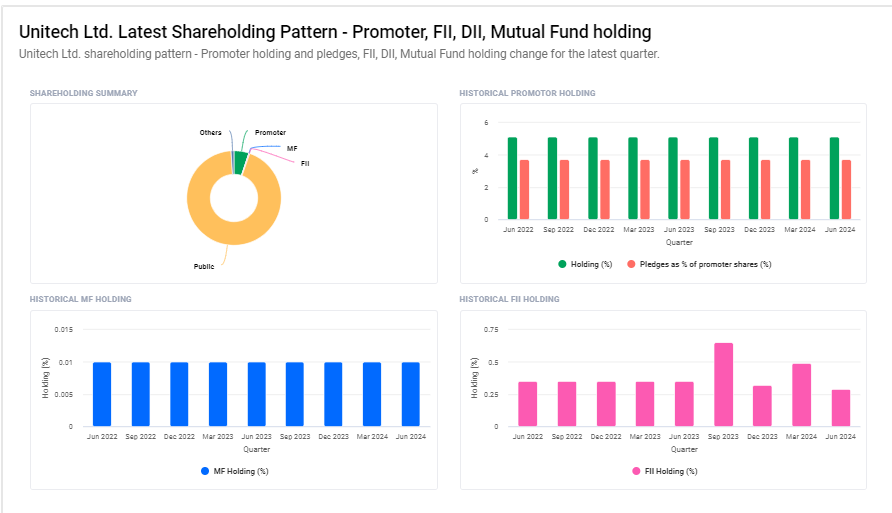

Unitech LTD Shareholding Pattern

- Promoter: 5.1%

- FII: 0.3%

- DII: 1.1%

- Public: 93.5%

Major Factors Affecting Unitech Share Price

Here are six major factors that can influence Unitech’s share price:

- Real Estate Market Conditions: Unitech’s performance is closely tied to the overall health of the real estate market. Fluctuations in property demand, prices, and sales can directly impact the company’s revenue and share price.

- Project Completion and Delivery: Timely completion and delivery of real estate projects are crucial for Unitech. Delays can lead to customer dissatisfaction, legal issues, and loss of investor confidence, negatively affecting the share price.

- Regulatory Environment: Changes in government regulations, such as those related to land acquisition, construction norms, or real estate taxes, can significantly impact Unitech’s operations. Favorable regulations can support growth, while restrictive ones might pose challenges.

- Debt and Financial Health: Unitech’s ability to manage its debt and maintain financial stability is key to its stock performance. High debt levels or financial difficulties can erode investor confidence and lower the share price.

- Market Reputation and Brand Value: The company’s reputation and brand perception play a vital role in attracting customers and investors. Any negative news or controversies can harm Unitech’s image, leading to a drop in share price.

-

Economic Factors: Broader economic conditions, such as interest rates, inflation, and economic growth, influence consumer spending on real estate. A strong economy can boost demand for properties, benefiting Unitech and potentially driving up its share price.

Read Also:-

- Ambuja Cement Share Price Target

- Maharashtra Bank Share Price Target

- South Indian Bank Share Price Target

- Power Grid Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.