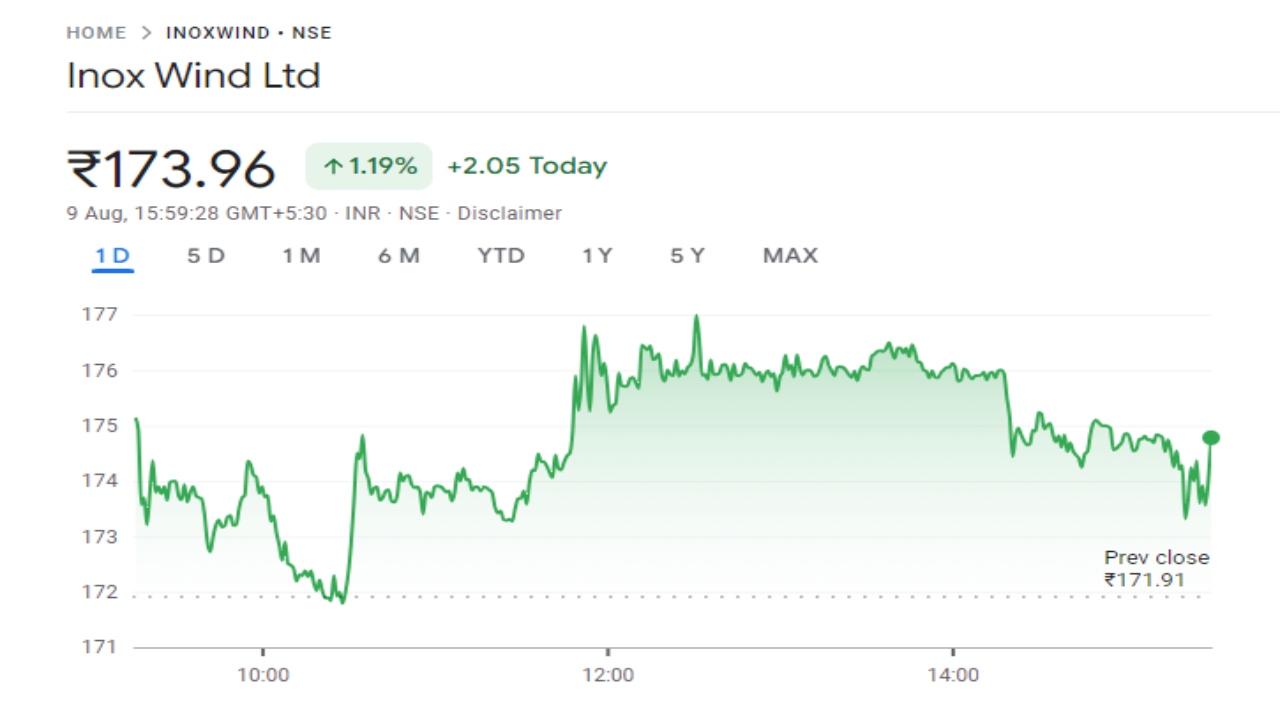

Inox Wind is a leading Indian company specializing in wind energy services. As a publicly traded company, Inox Wind is listed on both the National Stock Exchange of India (NSE: INOXWIND) and the Bombay Stock Exchange (BSE: 539083). Inox Wind share price on NSE as of 9 August 2024 is 173.96 INR. On this page, you will find Inox Wind Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Inox Wind share price target 2025 pdf, Why Inox Wind share is falling, Inox Wind share price target tomorrow, Inox Wind share price target 2030, and more Information.

Inox Wind ltd. Company Details

Inox Wind Ltd. is an Indian company that specializes in providing wind energy solutions. The company designs, manufactures, and maintains wind turbine generators and other related components. With a strong focus on sustainability, Inox Wind plays a significant role in promoting renewable energy in India. Their commitment to innovation and quality has made them a key player in the wind energy sector, helping to drive the transition towards cleaner and greener energy sources.

| Official Website | inoxwind.com |

| CEO | Kailash Tarachandani (2013–) |

| Director | Devansh Jain |

| Founded | 2009 |

| Headquarters | Inox Towers, Noida Uttar Pradesh, India |

| Number of employees | 831 (2023) |

| Category | Share Price |

Inox Wind Share Price Target Tomorrow

Here are the estimated share prices of Inox Wind for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| S. No. | Inox Wind Share Price Target Years | SHARE PRICE TARGET |

| 1 | Inox Wind Share Price Target 2024 | ₹210 |

| 2 | Inox Wind Share Price Target 2025 | ₹270 |

| 3 | Inox Wind Share Price Target 2026 | ₹300 |

| 4 | Inox Wind Share Price Target 2027 | ₹390 |

| 5 | Inox Wind Share Price Target 2028 | ₹500 |

| 6 | Inox Wind Share Price Target 2029 | ₹650 |

| 7 | Inox Wind Share Price Target 2030 | ₹800 |

Read Also:- IEX Share Price Target 2024, 2025, 2026 to 2030 and More Details

Market Position of Inox Wind Share Price Target

- MARKET CAP: ₹22.70KCr

- OPEN: ₹175.10

- HIGH: ₹177.00

- LOW: ₹171.60

- P/E RATIO: N/A

- DIVIDEND YIELD: N/A

- 52 WEEK HIGH: ₹190.00

- 52 WEEK LOW: ₹46.50

INOX WIND SHARE PRICE RECENT GRAPH

Factors Affecting Inox Wind Share Price Target

-

Company Performance

- Revenue and Profitability: Strong financial performance, including consistent revenue growth and profitability, can positively influence Inox Wind’s share price target. Investors are more likely to value the company higher when it demonstrates financial stability and growth.

- Renewable Energy Demand

- Market Growth: The increasing demand for renewable energy, especially wind power, plays a crucial role. As more countries and companies invest in green energy, Inox Wind’s potential market expands, which can lead to a higher share price target.

- Government Policies: Supportive government policies and incentives for renewable energy projects can boost the company’s growth prospects and positively impact its share price.

- Technological Advancements

- Innovation in Wind Technology: Inox Wind’s ability to innovate and improve wind turbine efficiency can attract investor interest. Cutting-edge technology and cost-effective solutions are key to staying competitive in the renewable energy market, influencing the share price target.

- R&D Investments: Ongoing investment in research and development to enhance product offerings and develop new technologies can positively impact the company’s future growth potential.

- Economic Conditions

- Global and Domestic Economy: The broader economic environment, both in India and globally, can affect Inox Wind’s share price. Economic growth generally boosts investor confidence, while economic downturns may lead to lower targets due to reduced demand for energy infrastructure.

- Interest Rates: Changes in interest rates can influence the cost of capital for Inox Wind, affecting its ability to finance new projects and, consequently, its share price target.

-

Competition

- Industry Competition: The level of competition within the wind energy sector can impact Inox Wind’s market share and profitability. Strong competition may pressure pricing and margins, affecting the share price target.

- Global Players: The presence of international competitors in the Indian market can also influence investor sentiment and Inox Wind’s valuation.

Read Also:- SRF Share Price Target 2024, 2025, 2026, 2027 to 2030 Prediction

Inox Green Energy Services Ltd Financials 2024

| Revenue | 2.24B INR | ⬇-11.78% YOY |

| Operating ExpeBSE | 720.10M INR | ⬇-7.72% YOY |

| Net Income | 279.10M INR | ⬆ 244.47% YOY |

| Net Profit Margin | 12.44 | ⬆ 263.68% YOY |

| Earnings Per Share |

|

|

| EBITDA | 748.70M INR | ⬆ 11.62% YOY |

| Effective Tax Rate | 10.81% | |

| Total Assets | 20.83B INR | ⬇-3.36% YOY |

| Total Liabilities | 7.33B INR | ⬇-28.35% YOY |

| Total Equity | 13.50B INR |

|

| Return on Assets | 0.65% | |

| Return on Capital | 0.84% |

Inox Wind Shareholding Pattern

- Promoters: 48.27%

- Retail And Others: 28.48%

- Foreign Institutions: 13.37%

- Mutual Funds: 7.75%

- Other Domestic Institutions: 2.13%

Read Also:- Tech Mahindra Share Price Target 2024, 2025, 2026 to 2030 and More Information

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.