Hello friends, Do you want to know about the future value of Ola Electric share price target? So you have come to the right page. Ola Electric is a leading Indian manufacturer of electric two-wheelers, headquartered in Bangalore. The company operates India’s largest two-wheeler EV manufacturing facility, located in Krishnagiri, Tamil Nadu. This state-of-the-art factory plays a crucial role in Ola Electric’s mission to drive the adoption of sustainable transportation across the country.

On this page, you will find Ola Electric Share Price Target 2024, 2025 to 2030 as well as Ola Electric IPO price band, Ola Electric share price history, Ola Electric share price BSE, Ola Electric share price screener, Ola electric share price target 2030, and more Information.

Ola Electric Company Details

Ola Electric is an Indian electric vehicle (EV) company known for its innovative approach to sustainable transportation. Founded as a subsidiary of Ola Cabs, Ola Electric has quickly gained recognition for its electric scooters, particularly the Ola S1 series. The company is committed to revolutionizing the EV market in India by providing affordable, eco-friendly transportation options. Ola Electric’s focus on cutting-edge technology, green energy, and a vision for a cleaner future has positioned it as a key player in the rapidly growing electric vehicle industry in India.

| Official Website | olaelectric.com |

| Revenue |

₹5,009 crore (US$600 million) (FY24) |

| Customer service | 080 3311 3311 |

| Founder | Bhavish Aggarwal |

| Founded | 2017 |

| Owners | Bhavish Aggarwal (36.94%)

SoftBank (21.98%) Tiger Global (6.03%) Ola Cabs (4.35%) |

| Headquarters | Bangalore, Karnataka, India |

| Number of employees | 3,733 (October 2023) |

| Category | Share Price |

Read Also:-

- Birlasoft Share Price Target

- Tata Chemicals Limited Share Price Target

- Tata Steel Share Price Target

- Ashok Leyland Share Price Target

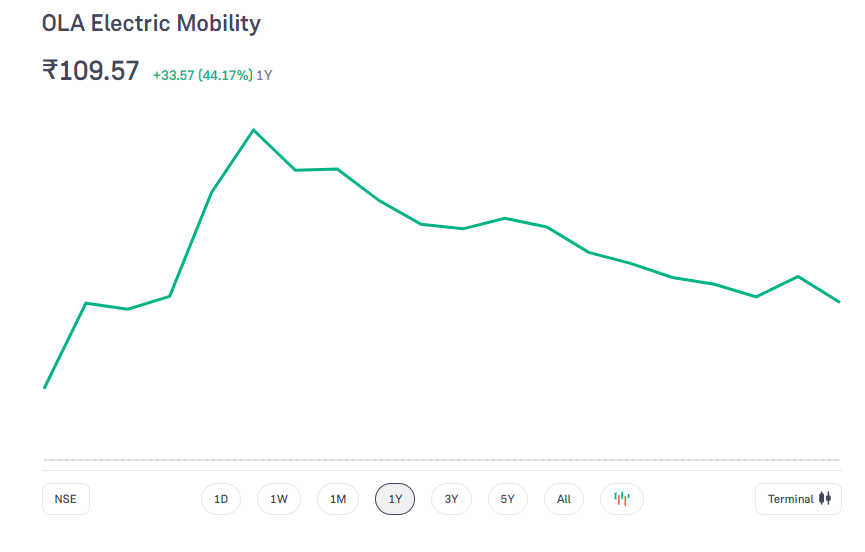

Current Market Overview Of Ola Electric Share Price

- Open – 118.50

- Prev. Close – 117.93

- 52-Week High – 157.40

- 52-Week Low – 76.00

- Volume – 1,89,61,924

- Total traded value – 218 Cr

- Market Cap ₹52,043Cr

- ROE -78.54%

- P/E Ratio(TTM) -8.25

- EPS(TTM) -3.59

Ola Electric Share Price Today Chart

Ola Electric Share Price Target Tomorrow

| S. No. | Ola Electric Share Price Target Years | SHARE PRICE TARGET |

| 1 | Ola Electric Share Price Target 2024 | ₹200 |

| 2 | Ola Electric Share Price Target 2025 | ₹360 |

| 3 | Ola Electric Share Price Target 2026 | ₹450 |

| 4 | Ola Electric Share Price Target 2027 | ₹540 |

| 5 | Ola Electric Share Price Target 2028 | ₹630 |

| 6 | Ola Electric Share Price Target 2029 | ₹720 |

| 7 | Ola Electric Share Price Target 2030 | ₹830 |

Key Factors Affecting Ola Electric Share Price Growth

Here are five key factors that can affect the share price growth of Ola Electric in simple, easy-to-understand language:

- Demand for Electric Vehicles (EVs): Ola Electric’s share price is closely tied to the demand for electric vehicles in India and globally. As more people switch to EVs due to environmental concerns and government incentives, Ola Electric’s sales can grow, which may lead to an increase in its share price.

- Government Policies and Incentives: Favorable government policies, such as subsidies for electric vehicles, tax benefits, and support for charging infrastructure, can boost Ola Electric’s growth. These incentives can encourage more buyers and investors, positively impacting the share price.

- Innovation and Product Offerings: Ola Electric’s ability to introduce new and innovative products, such as advanced electric scooters, bikes, or even electric cars, can help capture more market share. Successful product launches can drive investor interest, leading to share price growth.

- Competition in the EV Market: The electric vehicle market is becoming more competitive, with many new players entering the space. Ola Electric’s share price will depend on how well it can compete with other companies in terms of pricing, technology, and customer service.

-

Global Energy Trends: As the world moves towards cleaner energy solutions, companies like Ola Electric, which focus on sustainable transportation, can benefit from this shift. Growing global interest in green energy and reduced dependence on fossil fuels may enhance the company’s long-term growth, positively influencing its share price.

Risks and Challenges to Ola Electric Share Price

Here are five risks and challenges that can affect Ola Electric’s share price in simple, easy-to-understand language:

- High Competition: The electric vehicle (EV) market is crowded with both local and international players. Intense competition from established brands and new startups can make it harder for Ola Electric to maintain or grow its market share, which may impact its share price.

- Production and Supply Chain Issues: Manufacturing electric vehicles requires access to key materials like batteries, which can face supply chain disruptions. If Ola Electric encounters delays in production or struggles to get components, it can affect its ability to meet customer demand, leading to potential stock price fluctuations.

- Changing Government Policies: Ola Electric’s growth depends on favorable government policies and incentives for EV adoption. If these policies change or subsidies are reduced, it could slow down demand for electric vehicles, affecting the company’s revenue and share price.

- Battery Technology and Charging Infrastructure: The success of electric vehicles depends on advancements in battery technology and the availability of charging stations. If battery efficiency or charging infrastructure doesn’t improve as quickly as expected, it may slow EV adoption, which could be a challenge for Ola Electric’s share price growth.

-

Economic Downturn: A slowdown in the economy or reduced consumer spending can impact the overall demand for electric vehicles. During difficult economic times, people may be less likely to purchase new vehicles, which can affect Ola Electric’s sales and put pressure on its share price.

Read Also:-

- Hindustan Motors Share Price Target

- Sun Pharma Share Price Target

- Adani Green Share Price Target

- IOC Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.