NCC Share Price and Company Overview: Nagarjuna Construction Corporation, known as NCC Limited, began as a partnership and has grown into a prominent LLC. The company specializes in constructing flyovers, roads, buildings, and other infrastructure projects. Recently marking 40 years in business, NCC achieved a significant milestone with annual revenues reaching one billion dollars. Headquartered in Hyderabad, NCC Ltd.’s stock price currently stands at 316.65 INR (13 September 2024), fluctuating regularly on the stock market in response to diverse factors and the company’s operational performance.

NCC Limited Financials

| Total sales | 5260 crores |

| Total Equity Capital | 126 crores |

| Total borrowings | 1439 crores |

| Total Investments | 360 crores |

| Total Assets | 17567 crores |

| Market Capitalization Value | 16447 crores |

| Stock PE | 24.5 |

| Book value | 100 |

| Face value | 2 |

| Dividend yield ratio | 0.84 percent |

| ROE | 9.99 percent |

| ROCE | 18.7 percent |

| Categories | Share Price |

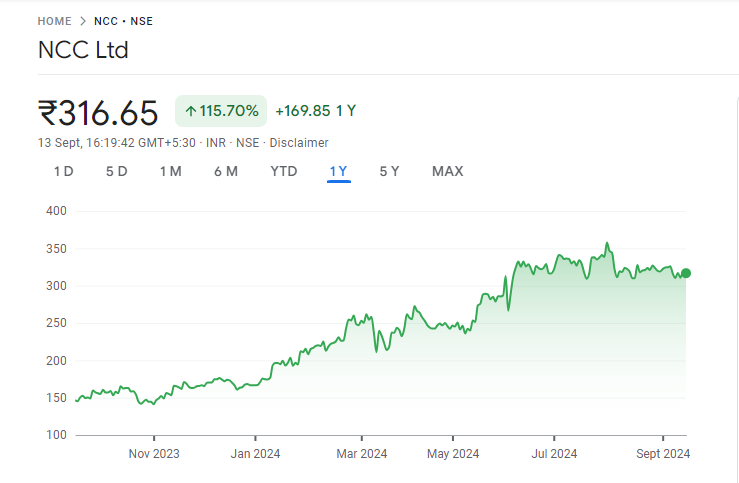

Current Market Overview Of NCC Share Price

- MARKET CAP: ₹19.88KCr

- OPEN: ₹318.95

- HIGH: ₹322.00

- LOW: ₹314.95

- Current: ₹316.65

- P/E RATIO: 26.63

- DIVIDEND YIELD: 0.69%

- 52 WEEK HIGH: ₹364.50

- 52 WEEK LOW: ₹136.55

NCC Share Price Today Chart

NCC Share Price Target Tomorrow

Here are the estimated share prices of NCC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | NCC Share Price Target Years | SHARE PRICE TARGET |

| 1 | NCC Share Price Target 2024 | ₹390 |

| 2 | NCC Share Price Target 2025 | ₹425 |

| 3 | NCC Share Price Target 2026 | ₹498 |

| 4 | NCC Share Price Target 2027 | ₹540 |

| 5 | NCC Share Price Target 2028 | ₹610 |

| 6 | NCC Share Price Target 2029 | ₹695 |

| 7 | NCC Share Price Target 2030 | ₹788 |

Read Also:-

- IRCON Share Price Target

- NHPC Share Price Target

- IDFC First Bank Share Price Target

- SBI Share Price Target

Key Factors Affecting NCC Share Price Growth

Here are five key factors that can affect the share price growth of NCC Ltd:

- Infrastructure Development and Government Policies: NCC operates in the construction and infrastructure sector, making its growth closely tied to government policies and infrastructure projects. Favorable policies, such as increased government spending on roads, bridges, and urban development, can boost the company’s project pipeline. A rise in government infrastructure initiatives would likely increase revenue, driving NCC’s share price upwards.

- Order Book Size and Execution: The size of NCC’s order book is a significant indicator of future revenue. A growing and diverse order book, filled with projects from various sectors such as real estate, transportation, and energy, signals strong future earnings potential. Efficient execution of these projects, without cost overruns or delays, also positively impacts profitability, thus boosting investor confidence and pushing the share price higher.

- Economic Growth and Urbanization: As the economy grows, especially in developing regions like India, the demand for new infrastructure increases. Urbanization drives the need for new residential, commercial, and industrial projects. NCC, being a major player in this sector, stands to benefit from economic expansion and urban growth, which could significantly contribute to its revenue growth and result in an upward movement in its share price.

- Debt Levels and Financial Health: NCC’s financial health, including its debt levels, plays a critical role in shaping investor sentiment. If the company manages its debt effectively, maintains a healthy balance sheet, and controls interest costs, it can improve profitability. Lower debt levels or the ability to service debt efficiently can improve investor confidence, leading to share price appreciation.

-

Raw Material Costs and Profit Margins: The construction industry is highly dependent on the cost of raw materials such as steel, cement, and labor. Any sharp increase in these costs can squeeze NCC’s profit margins, especially in fixed-price contracts. On the other hand, stable or falling material prices help protect margins and ensure better profitability, which would be viewed positively by investors, potentially driving the share price higher.

NCC Limited Shareholding Pattern

| Shareholders | Share percent |

| Promoters | 22 percent |

| FII | 23.9 percent |

| DII | 10.5 percent |

| Public | 43.6 percent |

Read Also:-

- GTL Infra Share Price Target

- Indegene Share Price Target

- Shree Renuka Sugars Share Price Target

- Motherson Sumi Share Price Target

FAQ

Q1. What is the price target of NCC in 2024?

Ans. The price target for NCC shares in 2024 is ₹390.

Q2. What is the price target of NCC in 2025?

Ans. The price target for NCC shares in 2024 is ₹425.

Q3. What is the price target of NCC in 2030?

Ans. The price target for NCC shares in 2024 is ₹788.

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.